Cyprus and Italy stop EBI downtrend

Written by Sebastian Wanke

|

25 February 2013

Posted in

sentix Euro Break-up Index News

The sentix Euro Breakup Index (EBI) for February increases from 17.15% to 19.25%. Consequently, the downtrend of the index is stopped, at least for the moment. At the same time, the current EBI value is still the second lowest since the indicator was launched in June 2012.

A reading of 19,25% means that about one in five investors expects at least one country to leave the euro zone within the next twelve months. The EBI had reached a high in July 2012 with 73%. The current survey was conducted from February 21st to February 23rd, 2013. 970 investors took part in the internet poll.

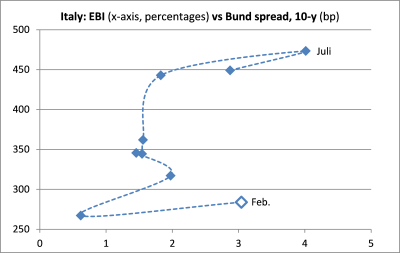

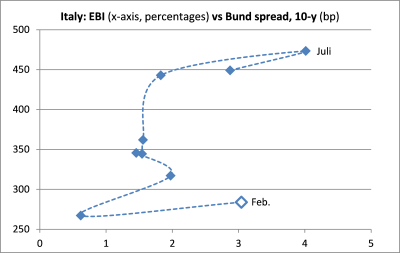

That the EBI has not fallen further (as in the six previous months) is mainly due to the investors' assessments of Cyprus and Italy. The EBI for Cyprus rises against the background of unresolved banking problems from 7.5% to 10.9%. For Italy the EBI climbs – just before the national elections – from 0.6% to 3.0%. That is the second highest reading for Italy since the EBI's inception. Only in July 2012 the index stood higher (at 4.0%).

In addition, the indices for Greece and Spain rise slightly. Greece remains the country for which most investors expect a euro exit within the next twelve months. Its EBI now stands at 15.3% (after 13.9%).

The positive surprise of the month is Portugal. Its EBI decreases for the seventh time in a row (from 1.5% to 1.4%). As a result, Portugal drops out of the list of those five countries with the highest EBI readings. It is replaced by Italy.

Among the countries with the five highest EBI readings remain the two core countries Germany and Finland. For both euro members the February readings rise slightly to 2.0% and 1.5%, respectively.

The February results of the sentix Euro Breakup Index show that at the current juncture the tensions surrounding the euro are not easing anymore. Reasons are probably the banking problems in Cyprus and the elections in Italy. Cyprus seems to have the potential to turn into a second Greece, although its present EBI is still lower than Greece's EBI ever was.

This month one could already observe investors' nervousness concerning political instabilities in Italy and Spain when looking at financial markets: Spreads for bonds from the euro periphery (over German Bunds) have stopped their downtrend. The February-EBI for Italy now even points to much higher spreads for Italian bonds than can be currently observed. If one looks at the history of the EBI, its current reading is indicating spread levels of around 450 basis points (bp) for 10-year bonds. This is not compatible with the actual ones of around 290 bp. But one has to bear in mind that the higher spreads in the past resulted from a much more euro hostile environment in general. Consequently, a comparison makes only partly sense.

The divergence between the actual and the theoretical spread, given a concrete EBI, may also result from the assessment of private investors. Private investors this month are much more pessimistic than their institutional peers regarding Italy (EBI for private investors: 4.5%, EBI for institutional investors: 1.6%). But it is institutional investors who have the greater weight for spread developments.

The divergence between the actual and the theoretical spread, given a concrete EBI, may also result from the assessment of private investors. Private investors this month are much more pessimistic than their institutional peers regarding Italy (EBI for private investors: 4.5%, EBI for institutional investors: 1.6%). But it is institutional investors who have the greater weight for spread developments.

Considering this, the February-EBI has to be understood as a kind of warning: While the euro zone experiences quite positive dynamics at the moment (reflected in other sentix data like the sentix strategic bias for stocks or the sentix eco indices), the situation remains fragile.

Read more...

The divergence between the actual and the theoretical spread, given a concrete EBI, may also result from the assessment of private investors. Private investors this month are much more pessimistic than their institutional peers regarding Italy (EBI for private investors: 4.5%, EBI for institutional investors: 1.6%). But it is institutional investors who have the greater weight for spread developments.

The divergence between the actual and the theoretical spread, given a concrete EBI, may also result from the assessment of private investors. Private investors this month are much more pessimistic than their institutional peers regarding Italy (EBI for private investors: 4.5%, EBI for institutional investors: 1.6%). But it is institutional investors who have the greater weight for spread developments.