The sentix Investment Theme Index, which is compiled around the first Friday of each month, is a measure of which themes will drive the European bond markets in the coming weeks from an investor's perspective. These sentix indices are thus suitable as short to medium-term forecasting instruments for the European bond markets and here in particular for Europe's most important bond market, namely Germany. The five individual indices on the topics of "inflation", "economic activity", "currency trends", "central bank policy" and "fiscal policy" are combined in the sentix indicator "Topic barometer for the bond market", which accordingly reflects the trends on the bond market in a concentrated form.

In addition, the above-mentioned five individual series can also be used to reveal developments regarding their respective underlying themes. For example, the sentix investment theme index "Inflation" can be used to forecast inflation, the index "Economy" can be used to assess the coming economic development, etc.

The indicators show trends and trend reversals particularly well. This property also supports thematic and media analyses: if a thematic index reaches an extreme value after a longer period of time, this is usually a signal that the (bond) market is only playing the given theme to a lesser extent and that it is thus increasingly fading into the background as a price-driving factor. Such a finding can complement a corresponding media analysis, which also aims to determine how far a topic has already "run" in the media tenor and how much effect it still has on prices.

sentix Investment Theme Index "Inflation"

To determine this thematic index, investors are asked for their assessment of the influence of inflation on European bond prices in the near future. The basic idea behind this indicator is that rising inflation expectations tend to lead to higher yields and thus lower bond prices - and vice versa. The construction of the index - as with the other thematic indices - is such that higher values also reflect higher expectations of bond prices. Thus, a rising indicator here indicates falling inflation expectations or rising deflation expectations.

The chain of effects behind the basic idea runs either via varying inflation premiums, which investors demand for an exposure to fixed-interest securities according to their inflation expectations, and/or via expectations of monetary policy, which in turn result from inflation expectations. If, for example, investors expect inflation to rise in the future, they will demand higher inflation premiums in the form of higher yields and/or they expect a more restrictive monetary policy with corresponding interest rate-increasing effects.

Since its introduction in 2004, the indicator has regularly shown the important trend reversals in inflation (in the annual rate of change) - with considerable lead time! This is illustrated by Fig. 1, in which the local extreme values of the indicator in 2008 and 2011 impressively anticipate the reversal points in the Euroland inflation rate. This shows that this thematic index is a good indicator of market participants' inflation expectations. Accordingly, it is also suitable for assessing the development trends of the Bund future rate and the yields of German government bonds (cf. Fig. 2).

|

|

| Figure 1: sentix investment theme index "Inflation" (inverse representation) and Euroland inflation (in the annual rate of change) |

Figure 2: sentix investment theme index "Inflation" (inverse representation) and yield of 2-year federal bonds |

sentix Investment theme Index "Economy"

Here, investors indicate what influence they perceive the economy to have on bond prices in the near future. The idea behind this indicator is that economic expectations also influence interest rate developments via expected changes in supply and demand on the capital market and/or expectations of monetary policy. If, for example, economic expectations rise, it can be expected that the demand for capital (for investment purposes) will increase soon, which should tend to raise the price of capital, the interest rate. At the same time, there is an increasing likelihood that monetary policy will become more restrictive in order to curb demand-related inflationary risks.

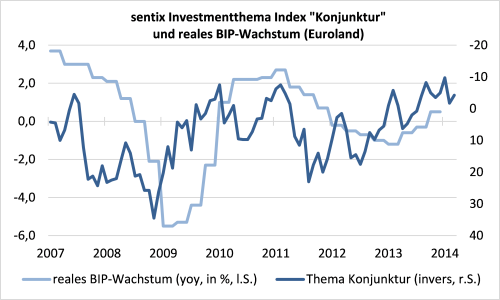

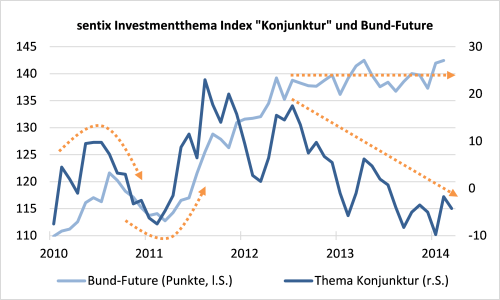

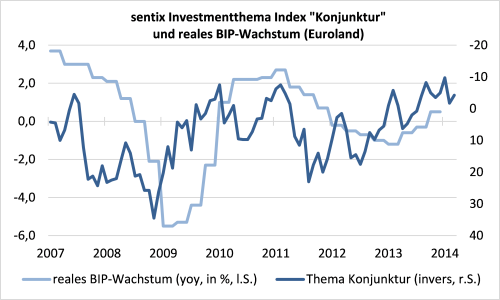

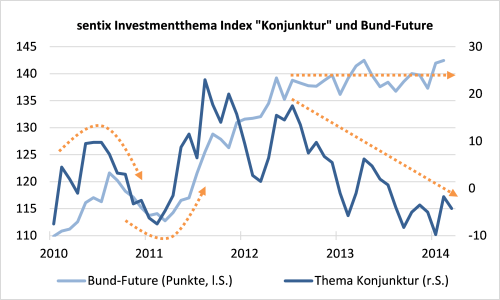

Similar to the inflation index (see above), the business cycle index serves two functions. First, it is suitable for anticipating major cyclical trend reversals. As can be seen in Fig. 3, the index already indicated, for example, the recovery that followed in 2009 at the end of 2008 or in 2012 - after ECB President Draghi's commitment to the euro - also the end of the recession at that time. Secondly, the indicator is thus also a forecasting tool for bond market developments, as Fig. 4 illustrates.

However, it can be seen that since the more consistent implementation of the unconventional monetary policy under ECB President Draghi since the end of 2011, a wedge has been driven between the indicator on the one hand and the Bund future or the yields of Bunds on the other (cf. again Fig. 3). While investors have since expected the economy to increasingly weigh on the bond market, interest rates have hardly reacted at all. The reason for this is probably the radical implementation of the ECB's ultra-expansive monetary policy. This is because it explicitly aims to keep interest rates as low as possible for as long as possible in order to combat deflationary tendencies as a result of the ongoing deleveraging of the euro area. Improvements in the economy or the economic outlook therefore currently no longer have the interest rate-increasing effects on the bond market that they used to. This example shows that the investment theme indices can also reveal anomalies that normally also dissipate over time. In this specific case, it can be assumed that a return to normal monetary policy on the part of the European Central Bank will be followed by a noticeable rise in yields, so in principle there is currently a subliminal downward pressure on bond prices, against which central bank policy is obviously successfully opposing.

|

|

| Figure 3: sentix Investment Theme Index Economic activity and growth of the real gross domestic product in Euroland |

Figure 4: sentix Investment Theme Index "Economy" and Bund Future |

sentix Investment theme Index "Currency trends"

The question behind this index is to what extent investors expect the development of the euro to influence European bond prices in the near future. The impact channel here essentially runs through the inflation expectations associated with the currency strength: If investors assume an appreciating (depreciating) currency, this lowers (increases) inflation expectations via cheaper (more expensive) imports. This would then have a dampening effect on interest rates (see also explanations on the thematic index "Inflation").

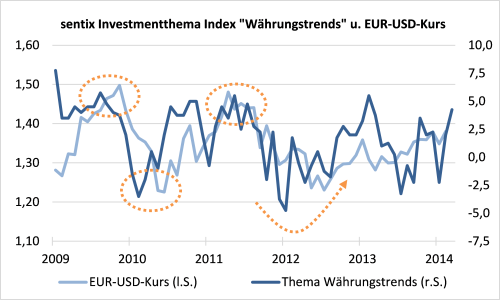

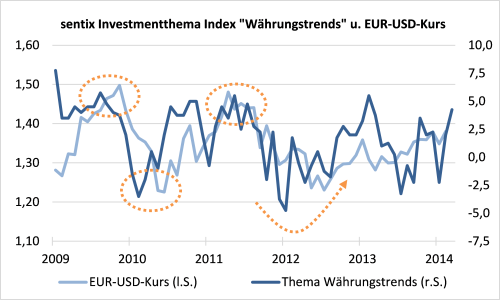

As with the thematic indices on the economy and inflation, it should be noted that the "currency trends" index fulfils two functions: on the one hand, it is a forecasting instrument for developments in the external value of the euro, which can be approximated by the EUR-USD exchange rate, and on the other hand, it serves as a signal for developments on the European bond market.

Compared to the other thematic indices, the "currency trends" indicator has a relatively loose connection to bond market developments, which is why an example chart is omitted here. Nevertheless, the "Currency Trends" index is an important component of the "Theme Barometer" (see below). It noticeably improves the informative value of this composite indicator.

|

| Figure 5: sentix investment theme index "Currency trends" and EUR-USD rate |

sentix Investment theme Index "Central bank policy"

This index is compiled by investors assessing whether central bank policy will play a "bullish" or a "bearish" role for European bond prices in the near future. The idea behind this is that central banks decisively influence interest rates on the money and capital markets through their interest rate policy or other measures such as (announced) securities purchases and through their general expectations management.

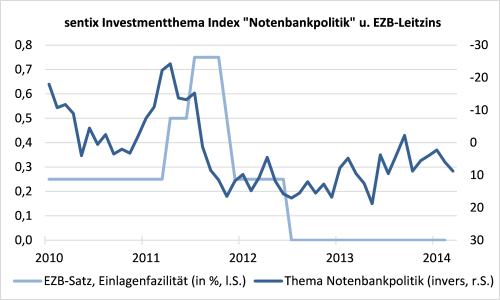

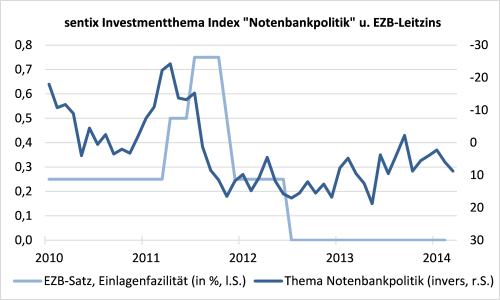

Like the other thematic indices, the indicator on central bank policy can be used as a forecasting instrument for the bond market. In addition, due to its construction, it is also an indicator for the development of central bank policy. For example, the index shows the development of the key ECB interest rate. However, due to the recent increased use of additional monetary policy instruments outside the classical interest rate policy - long-term tenders, securities purchases, expansion of the collateral framework, etc. - this connection threatens to become looser than in the past. Although these operations also influence the interest rate level, they do not change the ECB key interest rates when they are applied.

|

|

| Figure 6: sentix investment theme index "central bank policy" and ECB deposit facility rate |

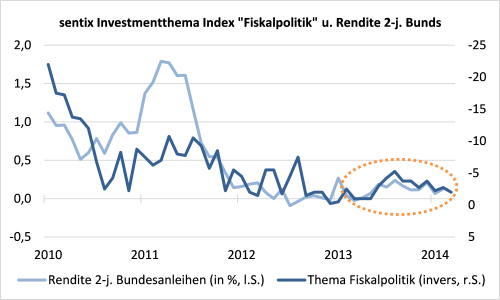

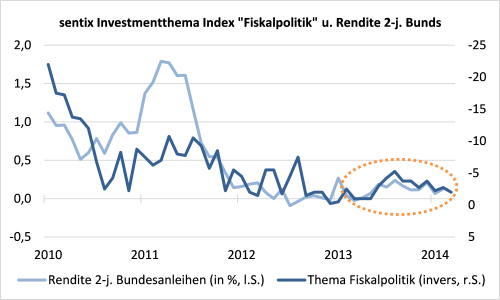

Figure 7: sentix investment theme index "fiscal policy" and yield of 2-year federal bonds |

sentix Investment theme Index "Fiscal policy"

This thematic index shows investors' perceptions of fiscal policy as a driver of bond markets. The basic idea here is that a more expansionary fiscal policy has negative effects on bond prices and a more restrictive one positive ones. The chain of effects behind this consideration can run either via cyclical and inflationary effects of fiscal policy or via credit rating considerations. A more expansive fiscal policy, for example, (ceteris paribus) boosts economic momentum and thus also inflation. This should lead to rising yields or falling bond prices (see also above comments on the other thematic indices). However, such a policy also means that government debt tends to rise and the creditworthiness of the (government) debtor can deteriorate as a result, which is why investors would then demand higher risk premiums. These would also be expressed in rising yields or falling prices.

In contrast to the other thematic indices, the fiscal policy indicator is essentially a forecasting tool for the development of yields or bond prices. It fulfils less the function of being an indicator for fiscal policy per se. However, the reason for this is solely the lack of availability of data on fiscal policy, for which the thematic index could be an indicator. On an annual basis, figures on the federal budget or the consolidated budget at the euro area level can be used. However, no suitable data exist at the frequency at which the Fiscal Policy Index is available, namely on a monthly basis.

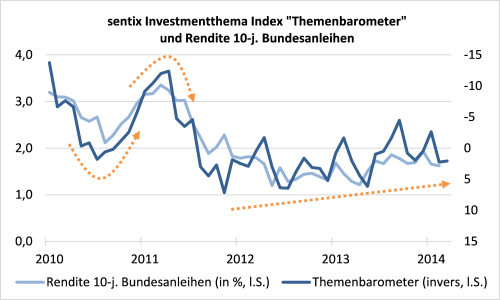

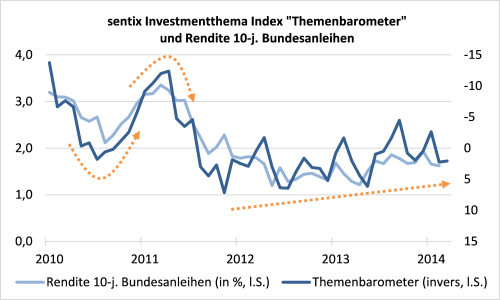

sentix Investment theme Index "Theme barometer for the bond market"

The index "Theme Barometer for the Bond Market" is an average of the five individual (and above) theme indices. It is particularly well suited for assessing the coming developments on the European bond markets. Investors' perceptions of the influence of the various themes on bond prices complement each other here in a meaningful way. This is because the composite indicator runs smoother overall than its sub-series. Temporarily stronger swings of the individual thematic indices, which could temporarily - when viewed exclusively - be misleading, obviously cancel each other out to the greatest possible extent here.

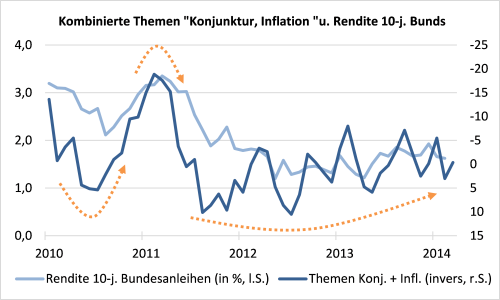

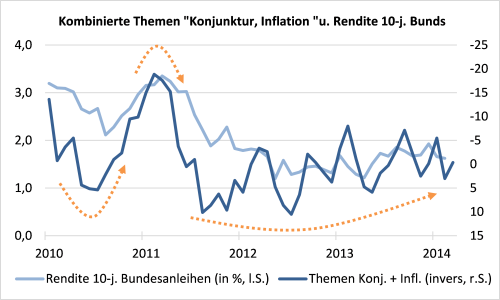

Of course, the individual theme indices can also be combined in other ways. We have found that the combination of the "business cycle" and "inflation" indices provides an indicator that shows the reversal points in the yield trends of the 2-year and 10-year Bunds particularly early on (cf. Fig. 9).

|

|

| Figure 8: sentix Investment Theme Index "Theme Barometer" and yield of 10-year Bunds |

Figure 9: Combined topics "business cycle and inflation" and yields on 10-year Bunds |

Indicator construction

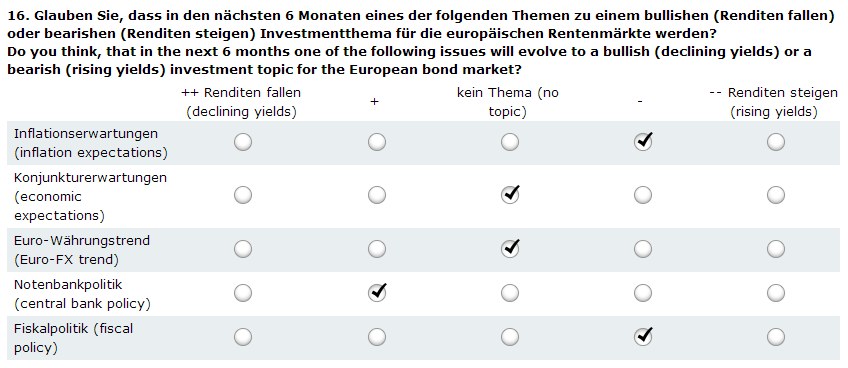

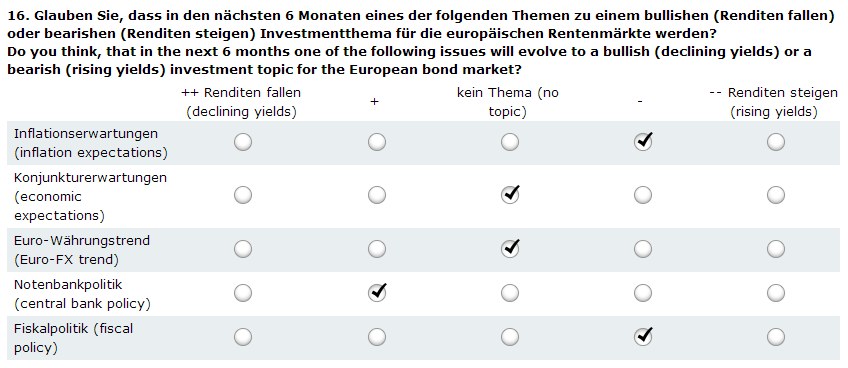

Questionaire

Note: The above figure is an extract from the sentix special survey on the sentix investment theme index, which is regularly surveyed together with the sentix economic index around the first Friday of each month.

Calculation formula

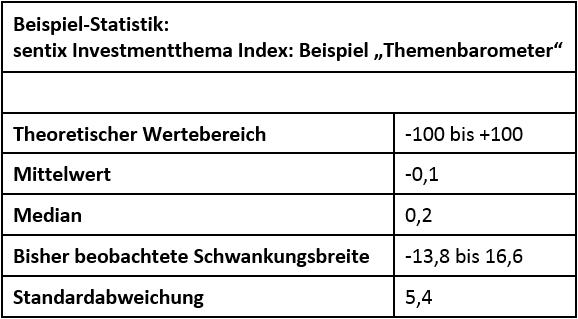

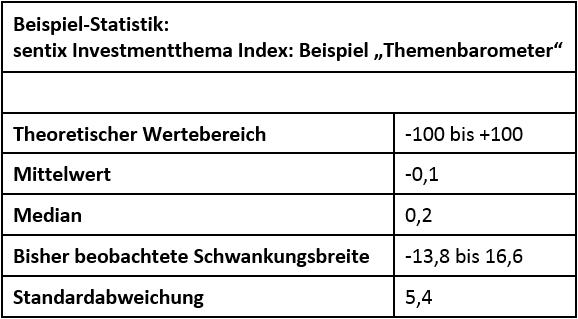

Descriptive statistics

s

s

entix Investment Theme Index, Descriptive Statistics - Source: own calculations

Customer Feedback (0)