The sentix economic index is the "first mover" among the monthly sentiment indicators on economic development. It is surveyed within two days at the beginning of the month among investors registered with sentix and published shortly afterwards. Thus, it is always the first available among the leading indicators such as the ZEW economic expectations, the ifo business climate or the economic sentiment. As a rule, the sentix Business Cycle Index has a leading character compared to the other indicators. With its help, the developments of the other indices can usually be estimated very well.

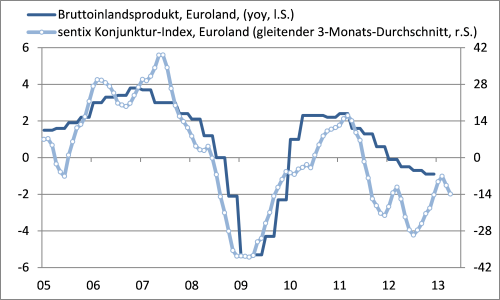

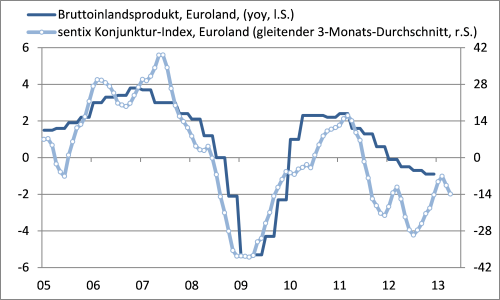

The sentix economic Index is basically a leading economic indicator that can be used to forecast the development of a country's or region's gross domestic product (chart below left). In addition, it is also an instrument for a better understanding of the financial markets. The sentix business cycle index is particularly suitable for interpreting financial market developments because it reflects the assessments of (surveyed) investors. It can thus give indications as to whether or not the motive of the economy is influencing prices at a certain point in time. Rising share prices, for example, could be the mere expression of excessive liquidity seeking an outlet - or a consequence of the fact that investors, i.e. market participants, expect a corresponding real economic dynamic in the future. Such an assessment would then be indicated by a rising economic index.

Since 2003, the sentix economic Index has been calculated from a monthly survey of over 5,500 private and institutional investors (as of September 2022) on their assessment of the economic situation and their economic expectations (6-month expectations). sentix calculates indices for these two sub-questions and also combines them into an overall index. Investors are surveyed on four regions and three countries. The overall index for Euroland is the central index, which is also regularly and comprehensively reported on in the media. It can be found in the publication calendars of news agencies such as Bloomberg or Thomson Reuters.

How to use the indicator

The sentix economic index is, on the one hand, a leading economic indicator that can be used to forecast the economic development of various countries and regions, measured in terms of gross domestic product. It reflects investors' perception of the economy. Therefore, on the other hand, the sentix Economic Index can also contribute to a better understanding of developments on the financial markets. This is because it provides indications as to whether or not the motive of the economy at a certain point in time is decisive for the actions of market participants and thus determines prices. For example, rising share prices could also result from excessive liquidity alone - or be the consequence of expected real economic dynamism, which is then expressed in a rising sentix business cycle index. The latter could be interpreted as a sign that the development is more sustainable or less risky than in a purely liquidity-driven market.

Like other sentix indicators, the sentix economic index uses its lows and highs - usually with a lead time - to indicate reversal points in both economic and financial market trends. The sentix economic index can thus provide entry and exit signals for markets and serve as an (additional) instrument for timing capital market investments. It also indicates when trends (in the economy or on the markets) are intact and can be followed. In addition, the sub-indices of the sentix economic index provide information on the maturity of a trend: Especially with regard to expectations, the developments of institutional investors usually run ahead of those of private investors: Consequently, a trend reversal is usually first announced via the time series of the institutional investors.

Illustration and examples

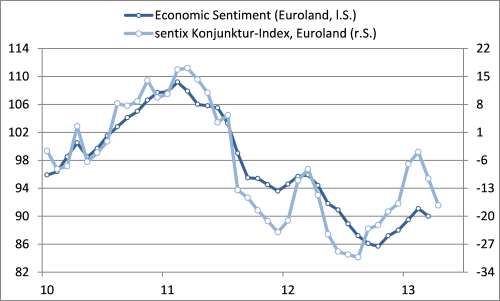

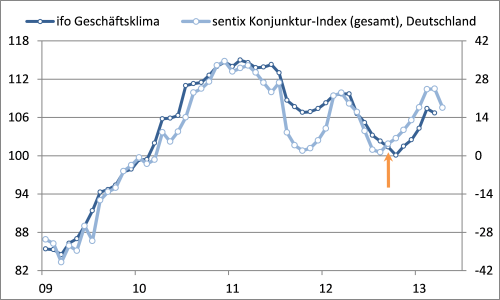

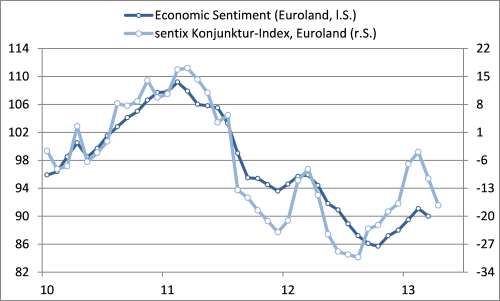

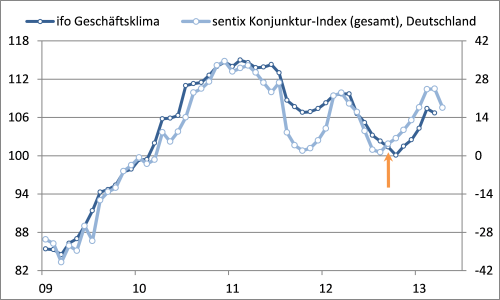

August 2012: The sub-indices of the sentix Economic Sentiment Index for Euroland and for Germany are turning upwards after ECB President Draghi declared the euro irreversible at the end of July. The sentix Business Cycle Index (total) will follow in September. The ZEW Indicator of Economic Sentiment for Germany did not reverse its trend until September (bottom left-hand chart), and the Ifo Business Climate, which is comparable to the sentix Economic Sentiment Index, did not reverse its trend until November (bottom right-hand chart).

März 2011: The sentix economic expectations for Euroland and Germany drop noticeably (chart below left), but the stock market does not follow until the end of July. For Euroland, a renewed phase of economic weakness begins in mid-2011, causing the European Central Bank to resort to unconventional measures (introduction of 3-year tenders) at the end of 2011.

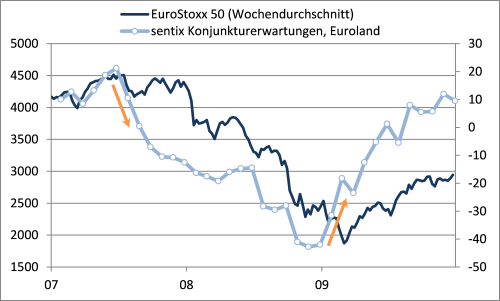

Januar 2009: The sentix economic expectations for Eurland turn upwards at the turn of the year 2008/2009 as a result of the announcement of various government spending programmes, the stock markets follow in March, the economy from the middle of the year (see chart below).

Juli 2007: sentix economic expectations plummet against the backdrop of the US subprime crisis. The downward trend continues until the end of 2008. The stock markets, however, remain relatively stable until the end of 2007 and even start to collapse massively in September 2008 - after the fall of Lehman Brothers (chart below).

Indicator construction

Question for situation assessment

Klicken um zu vergrößern

Klicken um zu vergrößern

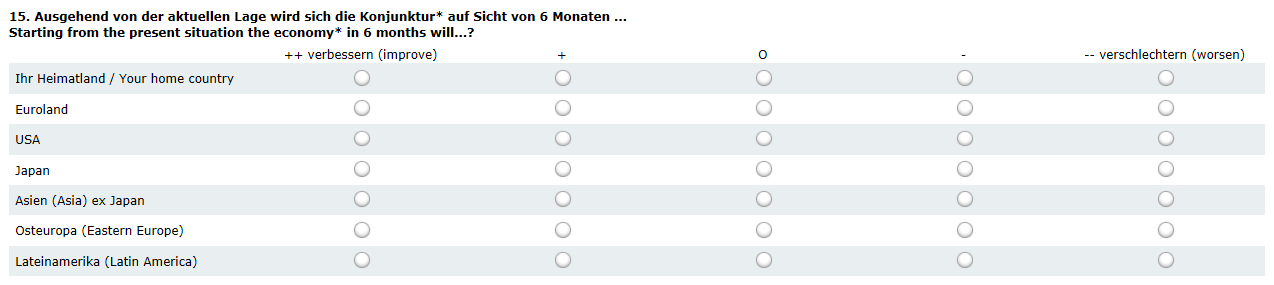

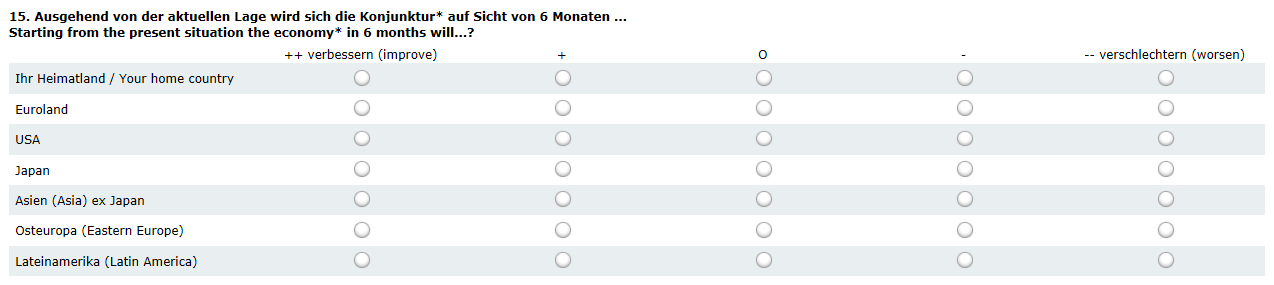

Question on economic expectations

Klicken um zu vergrößern

Klicken um zu vergrößern

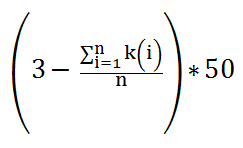

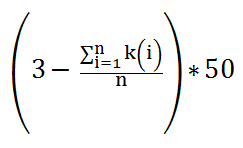

Formula for the sub-indices (current situation, expectations)

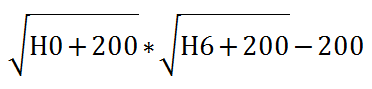

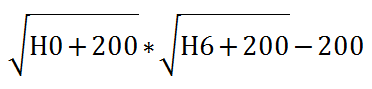

Formula for the overall index

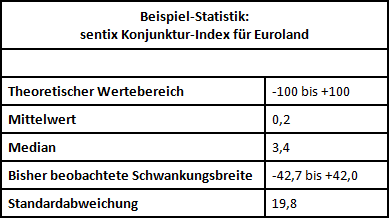

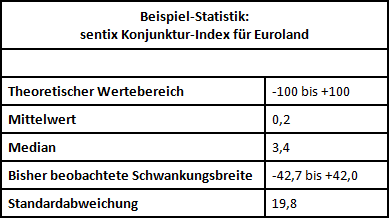

Descriptive statistics

sentix Konjunkturindex, Deskriptive Statistik - Quelle: eigene Berechnungen

sentix Konjunkturindex, Deskriptive Statistik - Quelle: eigene Berechnungen

Customer Feedback (0)