How to use the indicator

The sentix Sentiment helps with short to medium-term timing of investment decisions on the 14 financial markets that are covered by sentix data. Especially in the case of extreme values signals arise, i.e. when investors are exceptionally "bullish" or especially "bearish" in the short term.

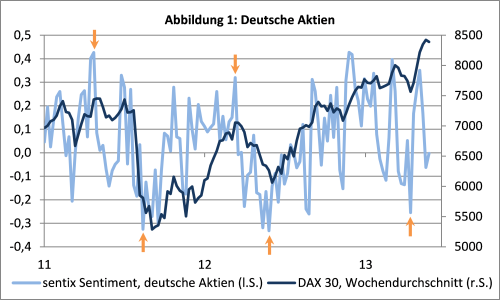

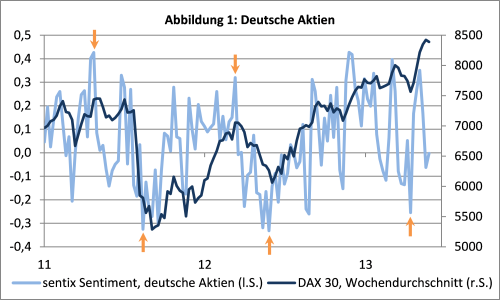

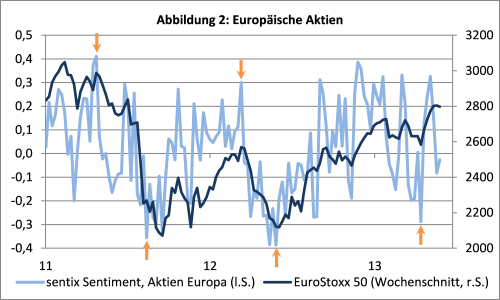

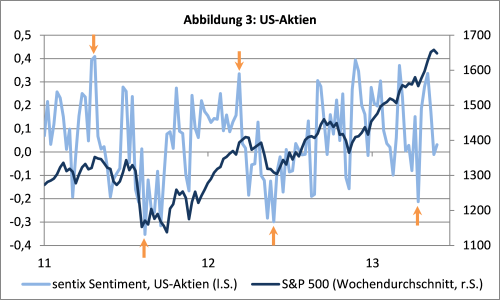

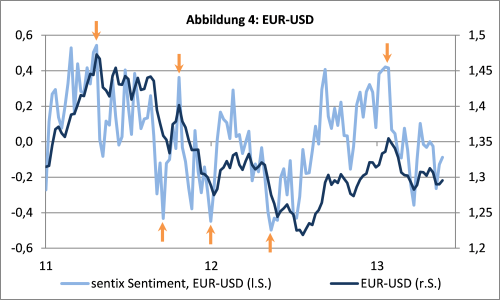

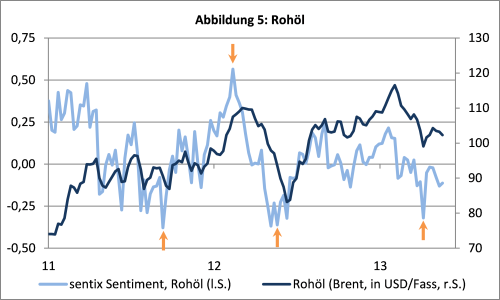

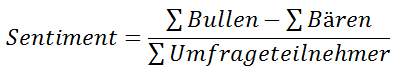

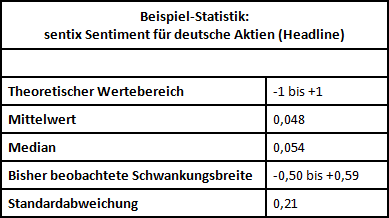

The rule of thumb here is: Extreme values exist when there is a bull overhang of more than 40% or a bear overhang of more than 30%. The sentix Sentiment then quotes above 0.4 or below -0.3. For the individual markets, however, there are slight differences in the definition of the extreme ranges using absolute values (see figures below). In case of doubt, normalized values, so-called Z scores, can be used here.

The rule of thumb here is: Extreme values exist when there is a bull overhang of more than 40% or a bear overhang of more than 30%. The sentix Sentiment then quotes above 0.4 or below -0.3. For the individual markets, however, there are slight differences in the definition of the extreme ranges using absolute values (see figures below). In case of doubt, normalized values, so-called Z scores, can be used here.

If the sentix Sentiment is located in extreme zones, it usually indicates that the market in question is overstretched in one direction. The received sentiment signal must therefore be interpreted in a contrary way. Examples are shown in the graphs below: The extremely bearish sentiment in German and European equities (Figures 1 and 2) in mid-2012 is particularly impressive as it indicates the lowest mark of the indices at that time. The extremely "bullish" sentiment on the oil market at the beginning of 2012 (Fig. 5), which anticipates a rapid decline in oil prices, also deserves to be highlighted.

Sentiment divergences additionally provide important information. They mainly occur in rising markets, when the relatively volatile sentiment does not manage to surpass the last peak after a maximum in the sequel. Such a constellation can - similar to an oscillator of technical analysis - be an indication that the price development of the market under consideration is on the verge of a top formation. Falling prices would then resolve the sentiment divergence.

The sentix Sentiment is also suitable for intermarket considerations since it is collected according to the same method and at the same time for 14 different financial markets. If the extreme sentiment for two markets is correspondingly opposite, they can be "played" against each other. However, since the fluctuation margins of the sentiment for the different markets partly differ from each other (see e.g. shares versus crude oil), it makes sense to normalise the sentiment values and present them as Z scores.

In combination with the medium-term oriented sentix Strategic Bias, the quality of the entrance and exit signals of the sentix Sentiment can be increased and the planned time horizon for the corresponding investments can be extended, e.g. by using the sentix Time Differencial Index.

Customer Feedback (0)