|

01 February 2016

Posted in

sentix Euro Break-up Index News

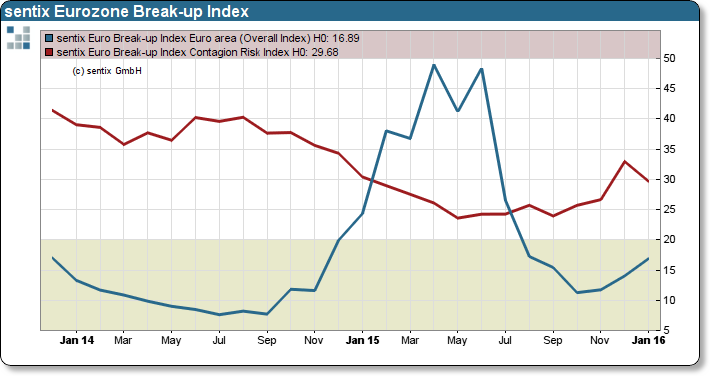

Investors increasingly worried about the shape of the Eurozone: The sentix Euro-Break-up Index (EBI) continues to raise 2.9 points reaching 16.9 in January. Climbing the third straight month. Besides the issues facing the periphery economies, lack of reforms and political stalemate increasingly worry investors.

In the past years, investors were mainly concerned about economic issues. However, recently societal and political issues dominate investors’ agenda. Besides unsolved issues in the banking system, increasing imbalances among members, the lack of labour market reforms and the rise of Eurosceptic political forces, migration woes commence to line up in an ever longer list of unresolved issues. Thus, the sentix Euro-Break-up Index (EBI) continues to raise 2.9 points reaching 16.9 in January. Recent attempts to explicitly solve pressing issues by giving up fiscal discipline only shifts the burden to future generations. However, it does not solve today’s issues. The sentix indicator measuring risks of EBI contagion stalls in January. The January index is slightly falls to 30%. Nevertheless, rising Eurozone government bond spreads point to further mayhem to come.