|

26 February 2019

Posted in

sentix Euro Break-up Index News

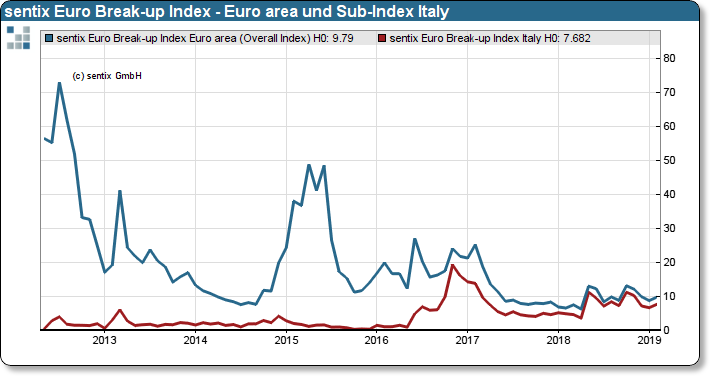

On the face of it, investors' concerns about the Euro-Zone's continued existence remain stable. The sentix Euro Break-up Index rose from 8.8% to 9.8%. But from the perspective of the investors surveyed by sentix, the probability of a break-up of the Euro zone is only at the average level of the last 18 months. In detail, the focus remains on Italy.

The fundamental picture that the sentix Euro Break-up Index gives of the stability of the Eurozone has hardly changed in recent weeks. Although the probability of the euro zone collapsing has risen slightly by one percentage point, but this does not lead to the conclusion of a new phase of uncertainty. The current value for Euroland of 9.8% is at the average level of the last 18 months. On a positive note, the current Brexit discussion has had no negative impact whatsoever on the stability of the euro zone. On the contrary, one can get the impression that investors are convinced of a stronger political will to hold the rest of the EU together "at all costs" in view of the drama surrounding UK's withdraw-al from the EU.

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy

Italy stands out as a problem child in the detailed examination of the individual countries. The sub-index climbed to 7.7%. Greece, a country in crisis for many years, on the other hand, with an EBI value of 3.3%, plays hardly any role as a candidate for concern at present. The index for the risk of contagion is correspondingly low.