|

27 October 2014

Posted in

sentix Euro Break-up Index News

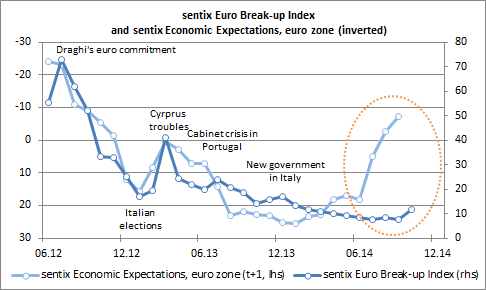

The sentix Euro Break-up Index (EBI) increases significantly in October from 7.7% to 11.8%. This is the highest reading since February 2014. The rising problems on the economic front of the Eurozone start again to undermine the stability of the Eurozone. To the weak readings in the EBI even the results of the Euro zone banking stress tests, which were already known in the market during the survey, could not change anything.

The October results of the sentix Euro Break-up Index (EBI) show a significant weakness. Fears of a break-up of the Eurozone showed a remarkable increase. And this time, not only the usual suspects are a concern for investors.

The national EBI for Greece rose heavily from 5.9% to 9%. That means that about 50% more investors expect Greece to be an exit candidate within a twelve-month time horizon. It is not only the weakness of the Eurozone that lead these concerns but also country specific developments, like the possibility of pre-mature parliamentary elections.

Cyprus has rising EBI values as well. The index increased from 2.7% to 4.4% in October. The geographic relationship to Greece, the conflict of the western countries with Russia and the persistent problems within the banking sector are a concern for the investors taking part in the sentix survey.

But the biggest surprise and the most worrisome development are the rising numbers in the EBI for France and Italy. For Italy, we report the third increase of the EBI in a row and the highest reading since March 2013 (current: 2.9%). France’s numbers are a little smaller, but the current index number of 2% means an alltime high of the Euro exit probability of the “grande nation”. The continuing deterioration in the economic conditions becomes more and more a problem for the bigger countries within the Euro area.

We note positive developments for the Iberian countries. The EBI values for Spain and Portugal decreased in contrast to the overall trend with a reading below the 1% mark.

Annotation relating to the graph: sentix Economic Expectations are inverted. Furthermore, all readings of the sentix Economic Expectations time series are shifted to a month earlier as this leads to a better fit of the survey periods of both indices. The sentix Economic Index is in most cases published in the week directly following the EBI's publication, but then carrying already the label of the following month, too.