|

28 July 2013

Posted in

sentix Euro Break-up Index News

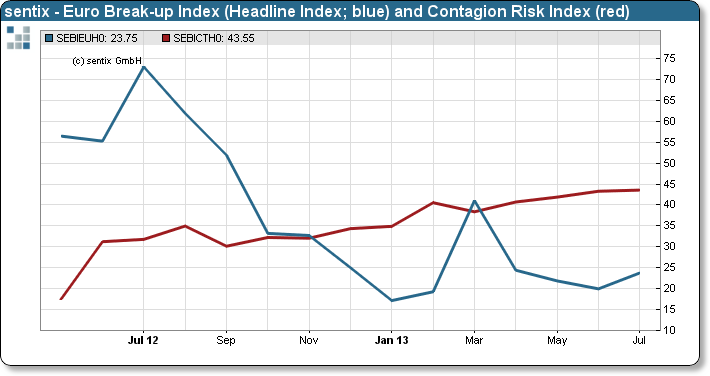

After three drops in a row, anxieties concerning the continuation of the Eurozone rise once more in July. The sentix Euro Break-up Index (EBI) rises by around 4% points from 19.95% to 23.75%. A decisive factor regarding this rise is the governmental crisis in Portugal which had a clearly negative influence on the Portuguese national EBI.

In the monthly EBI-survey, sentix identifies how probable investors consider a break-up of the Eurozone. In July 2013, 23,75% of investors believed that at least one of the current Euro-member states will leave the Eurozone. Although this is a clear rise in comparison to the previous month, it is also clearly below the values we saw in March of this year (41%, Cyprus confusion) or the highest value measured at 73% in July 2012.

This month, Portugal is an especially worrying factor for investors. The governmental crisis there and the irritations around possible snap elections had the national EBI rise from 2.66% to 5.38%. A doubling of the exit probability in just one month! With this, the Portuguese EBI hits its highest mark since September 2012.

All other member states of the Eurozone present themselves in a comparatively unchanged light. The EBI-value for Germany drops further from 2.99% to 2.32% - this should be bad news for the newly founded “Alternative für Deutschland” (AfD) party. Investor perception – and with it probably also that of the general population – does not point to a German Euro-exit.

For the weaker “Club Med” Euro states, this is only ostensibly a positive sign. Even if investors do not currently see an acute danger of a break-up of the Eurozone, the EBI does show that the danger of contagion has risen should a new aggravation of the crisis come about. The sentix Contagion Risk Index, which measures the risk of such a contagion, rose this month to a new all-time high at 43.55%. If investors were worried especially about Greece in July 2012, we have Cyprus since March 2013 and now, with Portugal, three states that hang in the balance should push come to shove.

Note: a value of 23.75% means that currently around every fourth survey participant is working on the assumption that at least one state will exit the Eurozone within the next twelve months. The sentix EBI, with it's one-year history, reached it's peak at 73% in July 2012, it's low was in January 2013 at 17.2%. 888 participants took part in the current survey, which was conducted between the 25.07. and the 27.07.2013.