|

26 November 2018

Posted in

sentix Euro Break-up Index News

Although the new Italian government is refusing to revise its draft budget and thus risk a further escalation with the EU Commission, investors are more relaxed about Italy's exit risk from the euro. Obviously, investors are counting on Italy ultimately to be disciplined by the capital markets in good time.

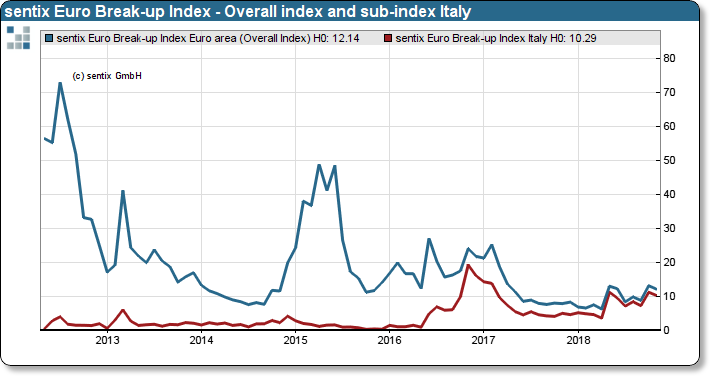

The risk, measured by the sentix Euro Break-up Index, of the euro breaking apart over a twelve-month period fell slightly in November compared with the previous month. Only 12.1% of investors still assume this risk. This shows a slight easing among the investors surveyed by sentix, although the Italian sovereign debt crisis has even reached a further escalation stage with the refusal of the Italian government to revise its budget draft. The Italian sub-index, which is currently the main source of uncertainty in the eurozone, is falling from 11.25% to 10.29%. Investors seem to be relying on the combined pressure of politics and capital markets to discipline Italians in time. Italy's rating is only one level above the junk level. There's no room for error any more.

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy

All in all, the euro zone remains in robust shape, which is also due to the fact that the figures for Greece have improved from 4.9% to 3.7%. Other countries are currently not in question from the investors' point of view.

Background

The sentix Euro Breakup Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Breakup Index can be found on http://ebr.sentix.de.

This month’s reading of 12.1% means that currently, this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012 and touched its low at 6.3% in April, 2018.

The current poll in which more than 1.000 institutional and retail investors participated was conducted from November 22nd to October 24th, 2018.

{slides}