|

30 March 2015

Posted in

sentix Euro Break-up Index News

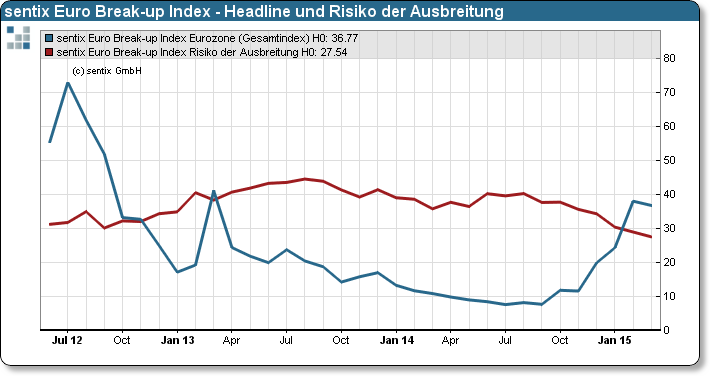

The probability for a break-up of the Euro area declined slightly in recent weeks. Nevertheless, with a reading of 36.8% the sentix Euro Break-up index is still on a remarkable high level. The prolongation of the “program” for Greece by the Euro area finance ministers did not make a big difference in terms of Greece. Indeed, it matters for the rest of the Euro member states as the “contagion risk index” shows.

The current policy of the Euro member states leads to a shared echo amongst investors. On the one hand, it doesn´t affect the exit probability of Greece. Still about 37% of investors expect at least one country to leave the Euro. Asked, who it will be, over 96% state Greece as the exit candidate. That is so far not new news as still is for many month in the focus of investors.

The real surprise and important message from this month EBI readings is the decline in the sentix Contagion Risk index. This index measure the probability that - in an event of a break-up - more than one country will leave the Euro. In March, this index fell to a new all-time low of 27.5%. The EBI numbers for countries like Spain, Portugal and Italy declined substantially. Even for Cyprus, a country economically tied to Greece, the national EBI number declined below the 10% mark, far below the numbers for Greece. As a result, from an investors perspective, the current policy doesn´t help Greece but stabilizes the Euro area as a whole. With or without Greece.