|

27 April 2020

Posted in

sentix Euro Break-up Index News

While the corona crisis is affecting economic life around the globe and politicians are trying to contain the economic consequences, investors seem to be thinking ahead and are increasingly worried about the financing of rescue pack-ages. They have identified Italy and Spain as critical candidates whose precarious financial situation could become a risk to the stability of the euro zone.

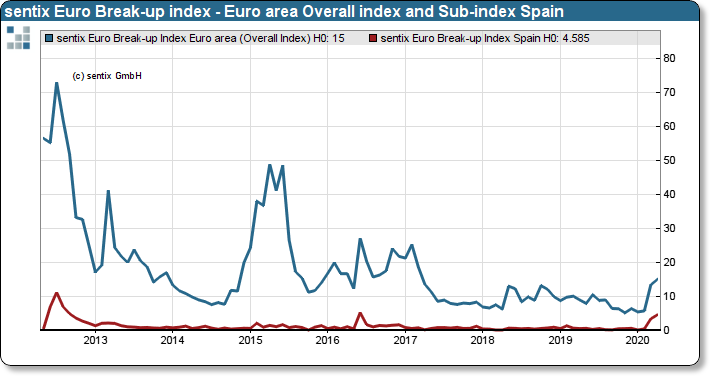

In April, the sentix Euro Break-up Index rises again by 1.5 points to 15 points. This reflects investors' higher assessment of the risks for the euro zone despite the agreement of the heads of state and government on a joint aid package to deal with the Corona crisis. This may also be related to the fact that in recent weeks it has become clear that the slump in economic output across Europe is far greater than previously thought. As a result, the financing needs of countries are also growing, and they are having to put together specific aid packages for more and more sectors. The classic tourism countries are particularly hard hit, as they are losing the revenue from an entire holiday season. However, these account for a large part of the economic performance. The financial overstretch of individual countries is thus in the offing - and with it the stability of the euro zone comes back into focus!

sentix Euro Break-up Index: Euro area Overall index and sub-index Spain

Greece, with an index value of 4.9 points, is currently relatively little affected. Here, too, there is a lack of income from tourism, but the ECB's willingness to buy up Greek bonds is currently covering up Greece's equally precarious situation on the capital markets.