|

26 May 2015

Posted in

sentix Euro Break-up Index News

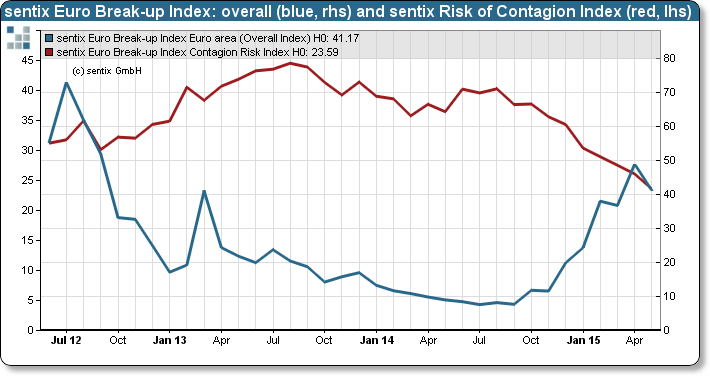

In May, the sentix Euro Break-up Index recedes from 49.0% to 41.2%. Investors obviously take – despite Greece’s still unclear future – comments of the Hellenic government seriously that the country wants to keep the common currency. And a default on its debt could still be an option while staying in the euro! At the same time, investors rate dangers of contagion emanating from a possible euro-exit of a country as fading.

Recently, statements of Greek officials have increased in number saying that one is determined to remain a euro member. As a result, the Greek Euro Break-up Index (EBI) falls and now stands at 40.7% after 48.3% in the previous month. This, in turn, leads to a decrease of the overall sentix EBI by around eight percentage points to 41.2%.

Consequently, uncertainty concerning the common currency’s future is still elevated just before the next Greek IMF payment is due at the beginning of June. But, at least, relaxation is observable. The avoidance of a “Grexit”, however, would not necessarily mean that the country would fulfill all its financial obligations in the future. Probably such a scenario has come more and more into the focus of investors’ thinking over the past weeks and thus has contributed to the fall in the EBI.

If Greece keeps the euro, this should hold all the more true for the rest of the currency-club members. Thus, on a nation-al level it is – besides Greece – only Cyprus that sticks out with an EBI of 6.3% (after 10.6% in April). All other national indices display negligible levels, and that is why the sentix Contagion Risk Index falls to a new all-time low (see graph).

At first sight, the generally low EBI readings could be understood as a positive sign for the spreads of euro-zone government bonds. But, if behind this there is actually the conviction that possible future defaults could occur while keeping the euro, this would undoubtedly be very bad news for the periphery!