|

29 July 2019

Posted in

sentix Euro Break-up Index News

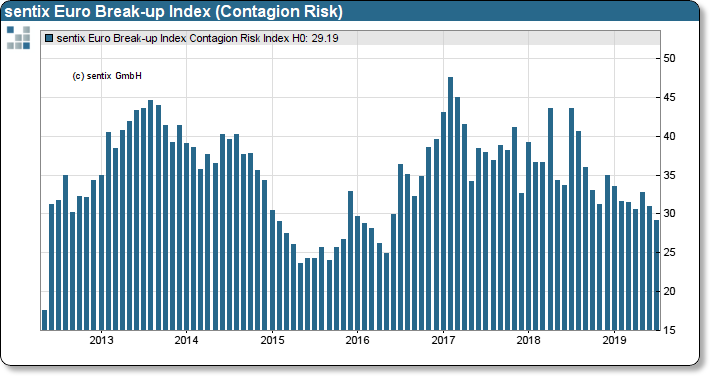

In Euroland, summer rest begins. Following the European elections and the filling of government positions in the EU, Italy has also recently brought some relief. This is reflected in the Euro Break-up Index, which at 8.9 points once again falls below the 10 percent threshold. The easing is even more visible in the index, which measures the risk of contagion. This one marks a new three-year low.

The summer slump on the European political stage can also be felt in the EBI. The rapid agreement in poker on the appointment of EU and ECB leaders has led to a slight smoothing of the worries among investors about the Euro zone. This can be seen in many ways: On the one hand, the Euro Break-up Index is once again moving in the single-digit range, thus oscillating unobtrusively in its narrow range between 7.9 and 10.5 points, which it formed in 2019. The temporary hint of a renewed political escalation in Italy also seems to have vanished, with the subindex for Italy falling back from 8.2 points to 6.7 points.

sentix Euro Break-up Index: Contagion Risk

Even more striking is the decline in the index, which measures the risk of contagion from potential exit candidates from the euro zone. The index drops to a three-year low of 29.2 points. This makes the danger of a leapfrogging of exit risks to other countries less likely, which should therefore also further favour the convergence of bond yields on the euro government bond markets.