|

25 September 2017

Posted in

sentix Euro Break-up Index News

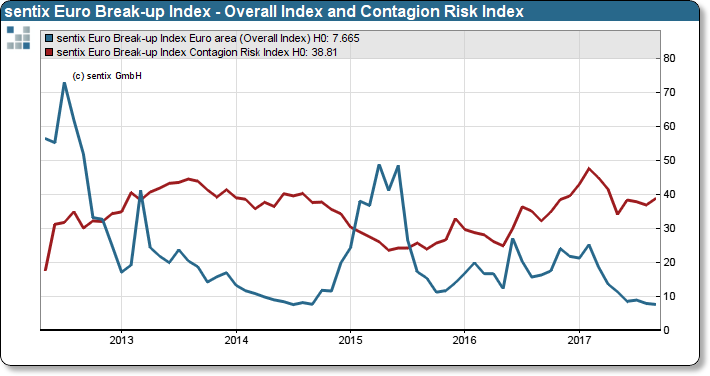

There is peace on the Euro front. At least this was the case before the Bundestag elections. The sentix Euro break-up index dropped slightly again to 7.66% in September. This is the lowest value since July 2014, when the all-time low of the index was reached at 7.61%. All major country indices have yielded in line with this tendency. But whether this peaceful state still holds after the election is questionable.

Jean-Claude Juncker is a fan of the euro. As soon as the worries about the common currency are over, the enlarge-ment of the Eurozone is once again a desirable goal. This, and the promotion of Portugal by a rating agency, show the solid position that currently characterizes the euro. In figures, this can be seen in the sentix Euro Break-up Index, which dropped again in September and is now only marginally above its all-time low of 7.61% (from July 2014). In the case of the sub-indices, the focus is on two Mediterranean countries, Italy and Spain. The Italian value has once again fallen, which is surprising in the face of the increasing popularity of Euro-critic parties. The Spanish index, on the other hand, has indeed risen but is not significant, and thus does not reflect investors' concerns before the Catalan's planned independence referendum of the coming weekend.

sentix Euro Break-up Index: Headline Index Euro area and contagion risk index (left scale)

This rest, however, may turn out to be deceptive. On the one hand, the contagion index shows that the risk of infection still exists even though they are hidden by the low EBI value. On the other hand, the Bundestag election brought a problematic election result. The FDP appears to be able to op-pose a continuation of the current rescue policy. And Chancellor Merkel, who was considered a rock in the Euro crisis, is greatly weakened by the election. It is unclear whether it can really come to the expected intensified cooperation between Germany and France. All of this is taking place against the backdrop of the 2018 Italy elections, which are like-ly to become increasingly visible in the markets. Here the Euro critic tones determine the scenery so far.

The EBI is likely to have reached its lowest level for a while.