|

29 May 2017

Posted in

sentix Euro Break-up Index News

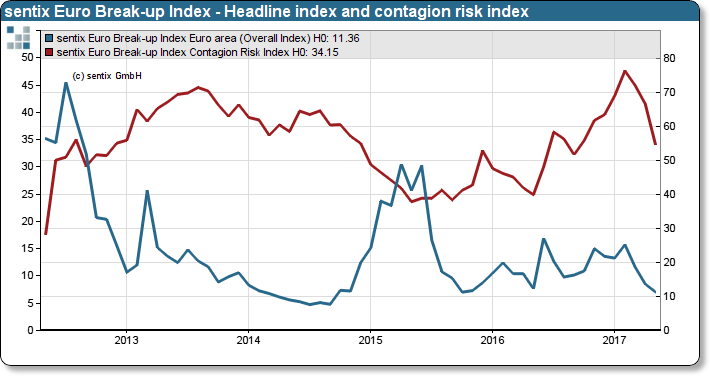

Following the French presidential elections, investors' perception of the euro crisis has once again relaxed considerably. The overall Euroland index fell to 11.4%, the lowest since autumn 2015. While the Greek sub-index remains virtually unchanged, the probability of exit from France and Italy drops significantly. As a result, the risk of contagion is reduced to around 34%.

The final election of Emanuel Macron to the new French president and the accompanying political signals aimed at closer cooperation in the European Union have once again had a positive effect on investors' perceptions of a break-up of the Eurozone. The Euroland overall index of the sentix Euro break-up index drops to 11.4%, the lowest since Oc-tober 2015. The risk of exit from France and Italy has decreased significantly, with a sharp decline in the contagion risk index.

sentix Euro Break-up Index: Headline Index Eurozone and contagion risk index (left scale)

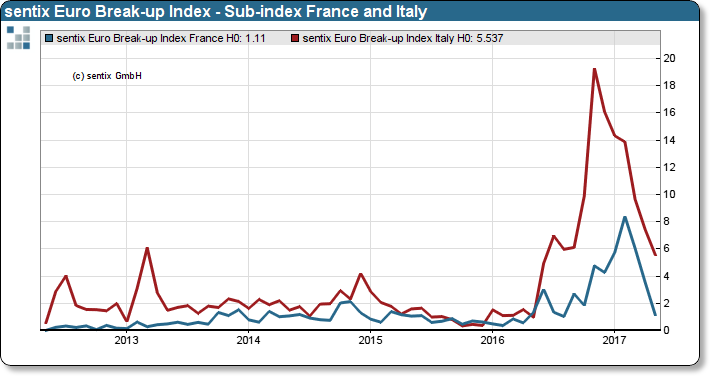

The sub-index for France falls to 1.1% and thus close to insignificance. In Italy, too, we are seeing a significant decrease in the risk of exit (from 7.4% to 5.5%). Only Greece remains a significant risk for the euro from the point of view of investors. The index here only drops by 0.5 percentage points to 8.2%.

sentix Euro Break-up Index – Sub-indices for France and Italy