|

26 May 2014

Posted in

sentix Euro Break-up Index News

In May, the sentix Euro Break-up Index (EBI) falls from 9.8% to 9.0%. This again marks a new low in the history of the now two-year old indicator.

This month two developments are outstanding: Firstly, the national EBI for Italy now stands at 1.5% and thus, for the first time since the beginning of the year, clearly below the 2% threshold. Investors' nervousness surrounding Italy's government change in February has now faded a little. Secondly, the German index climbs from 1.0% to 1.7%. The European elections and the discussion about the euro-skeptic German party AfD have made investors once more aware of the fact that there is still a non-negligible number of euro-critics in Germany. This development now makes the German EBI the third highest behind the ones for Greece (6.7% after 7.1%) and for Cyprus (3.7% after 4.1%).

What comes as a little surprise is that the EBI for France remains almost unchanged at 1.1% (after 1.0%). Despite the recent weak French economic data and despite the strengthening of the euro-skeptic Front National investors do currently not see France and the euro as a contradiction. It has to be mentioned that the EBI survey closed already last Saturday, so just shortly ahead of the publication of the results of the European elections. But the strong rise in votes for the Front National had been already indicated by the polls that were conducted before the elections. Nevertheless, the French EBI has not reacted on that.

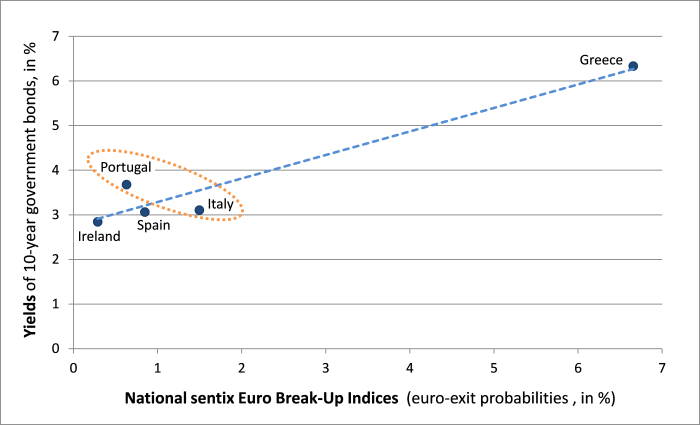

Consequently, investors leave the euro crisis more and more behind them. This is also mirrored by falling spreads between the yields of government bonds of the periphery and of Germany. The potential for a further spread compression has now significantly diminished, all the more that the national EBI of the periphery countries (except for Greece and Cyprus) stand now already close to zero. But there persists still one peculiarity regarding the relative yields of the periphery countries: Taking the EBI as a yardstick, Italian bonds still look relatively too expensive (yields look too low) and Portuguese ones relatively too cheap (yields too high) – if one compares them with each other. So, there still exists some room for a tightening of the Portuguese-Italian spread.