|

28 July 2014

Posted in

sentix Euro Break-up Index News

The sentix Euro Break-up Index (EBI) further recedes in July and now stands at 7.6% after 8.5% in the previous month. This, once more, is an all-time low. Only for Greece, Cyprus and – against the backdrop of the Espírito Santo crisis – once again for Portugal investors still see noteworthy euro-exit probabilities.

Two months after the European elections, optimism among investors concerning a continuation of the euro zone in its current shape rises further. Again, the developments of two countries which since the start of the euro-zone crisis have found each other at the two ends of a fictional ranking of government bond yields take centre stage: Greece and Germany. For both, the national EBIs fall by 0.7 percentage points. As a consequence, the German EBI now stands at an almost negligible 0.4%, and for Greece at only 5.7%. Both readings mark all-time lows. In addition, the development of Italy's EBI is worth of note. It also falls noticeably to a level of 1.1%, its lowest since January 2013. This occurs while the newish prime minister Renzi continues his reform process.

Against the general trend of the month, Portugal's EBI rises from 0.5% to now 1.6%. Here, the crisis of Banco Espírito Santo has obviously influenced investors' perceptions. Alongside Cyprus whose EBI stands at 3.5% in July and the above mentioned Greece, Portugal thus is one of only three countries left for which investors still see a noteworthy euro-exit probability (of clearly more than 1%) within the next twelve months.

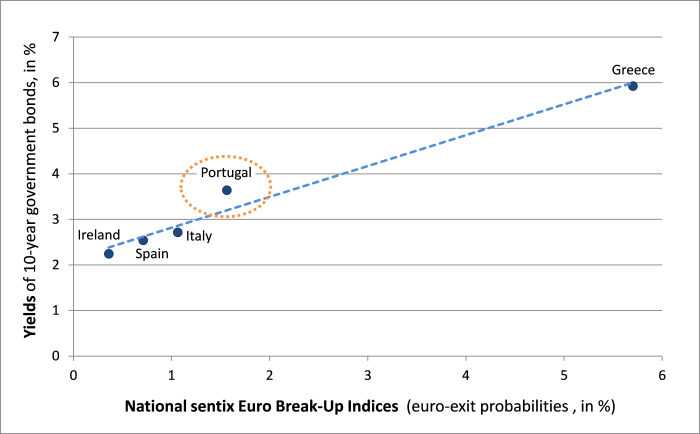

What do these developments mean for the spreads of euro-zone government bonds? If one takes the EBI data as a yardstick for the valuation of, for instance, the yields of 10-year government bonds, there is only Portugal left whose yields still stick out. Here, the yields are – given the na-tional EBI – too high when compared to the EBI-yield-combinations of the rest of the so-called periphery countries (see graph). Consequently, one should expect an outperformance of Portuguese titles in the near future. This sounds all the more plausible as investors' perceptions will probably be less and less dominated by the Espírito Santo crisis over the coming weeks.