|

25 June 2018

Posted in

sentix Euro Break-up Index News

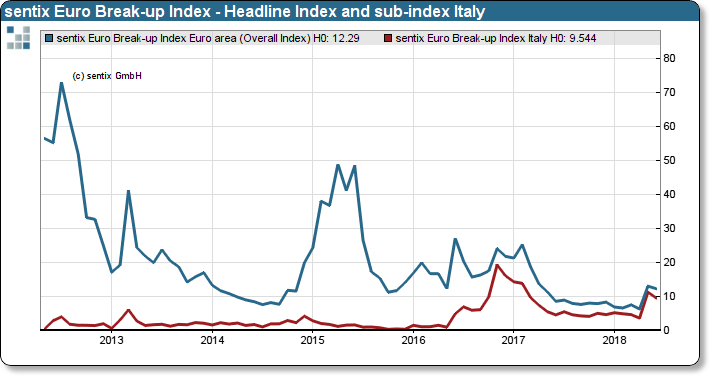

Despite the unrest in the European Union triggered by the new government in Italy and the issues in EU migration policy, there has been no further increase in the sentix Euro Break-up Index. On the contrary: the overall index even fell slightly from 13.0% to 12.3%. Private investors are much more nervous than institutional investors.

Even if the economic signs in the Eurozone, according to the sentix economic index and other leading indicators, have weakened rather slightly and Europe's politicians are rushing from mini-summit to the right summit to find a common position in the EU migration crisis, investors are hardly worried. The sentix Euro Break-up Index fell slightly to 12.3% in June. The decline in the Italian sub-index made a significant contribution to this. Investors are not really relaxed about the new Italian leadership, but a negative spiral does not seem to have been set in motion either.

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy

Overall, the more solid impression of the euro zone is confirmed this month as well. The Greek index increased slightly with the end of Community aid payments. However, the risk of infection index is practically unchanged. At the moment, Italy is the only country that is being looked at with concern, without emanating to other countries.