|

03 March 2014

Posted in

sentix Euro Break-up Index News

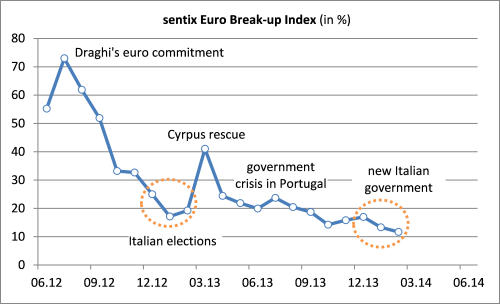

The sentix Euro Break-up Index (EBI) for February falls to a new all-time low of 11.7%, coming from 13.3% at the year's start. The reading of the sentix EBI shows that currently less than one in eight investors expects at least one country to leave the euro area within the next twelve months.

Against the background of a return to economic growth in the euro area and falling unemployment in most periphery countries the almost 1,000 investors surveyed by sentix think that it is ever more improbable that the currency union will break-up in the coming months. Still, it is Greece and Cyprus for which investors are most skeptical as far as a continued membership in the euro club is concerned. But even the sorrows surrounding these two do not stop to fade. The national EBIs both fall to new all-time lows: For Greece the index reaches with 9.4% for the first time since its launch single-digit territory (after standing at 10.8% the previous month). For Cyprus the EBI falls by 1.3 percentage points to now 5.3%.

Negative news this time come from Italy. The new government does seemingly not really please investors – even if the irritation is not as strong as it was one year ago when Italy faced elections and also a change in government. Currently, Italy's EBI rises by 0.6 percentage points to 2.3%. At this level, Italy is after Greece and Cyprus the country that is most often cited as a euro-exit candidate by the investors in the sentix poll. Until recently, it was Portugal that displayed the third highest EBI of all euro members. In February, the Portuguese EBI drops slightly to a reading of 1.5% -- which is even below the current German reading of 1.7%.

A glance at the universe of government titles reveals that Italian bonds – taking the national EBIs as yardsticks – once more look too expensive, especially when compared with Spanish and Portuguese bonds. The reasoning behind this is relatively simple: The EBIs for Spain (1.0%) and Portugal are clearly lower than that for Italy. Nevertheless, the yield for 10-year government bonds, for instance, are slightly higher and noticeably higher for Spain and Portugal, respectively.