|

26 September 2016

Posted in

sentix Euro Break-up Index News

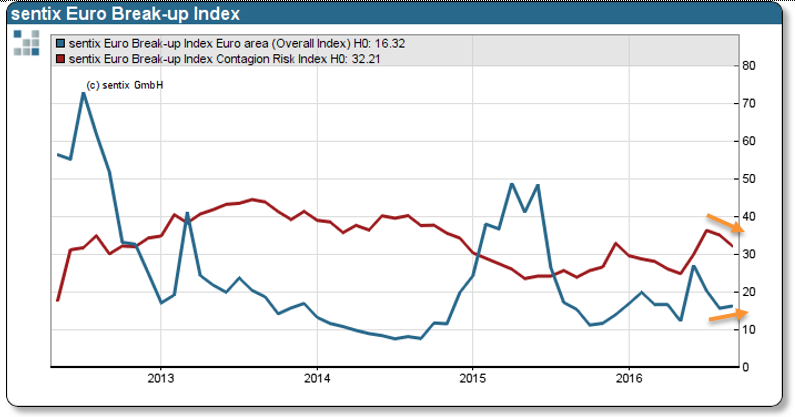

The fragile condition of the Eurozone has not improved in comparison to previous months. The September results draw a gloomy picture. The sentix Euro Break-up Index (EBI) for the Eurozone rises to 16.3 points, while in the meantime contagion risks have slightly fallen. Especially the situation of the Portuguese and Greek economy continues to cause worries with investors.

Even in September 2016, the threat of a Eurozone collapse is not entirely averted. While investors sense a significant lower contagion risk (the sentix indicator which measures the risk that the crisis spreads to other economies fell by -3 points), the sentix Euro Break-up Index could not deliver the further sign of easing. Quite contrary to expectations, the risk that a member country quits the single currency has slightly increased by +0.6 points in comparison to the previous month.

sentix Euro Break-up Index and sentix Contagion Risk Index

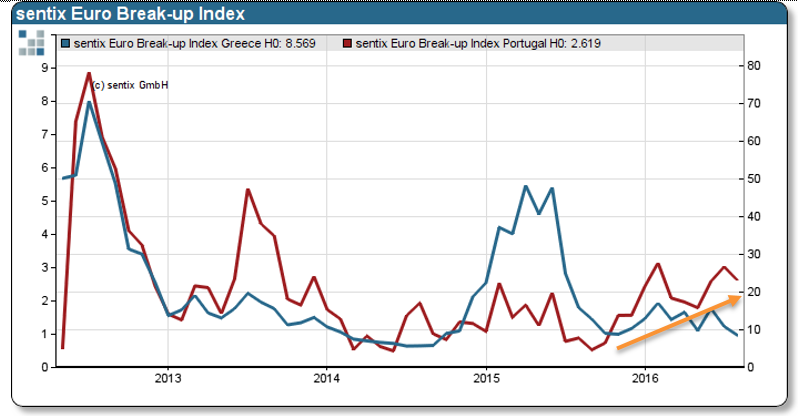

The positive news first: the sentix sub-indicators for the Netherlands, Austria and Finland have entirely recovered from the“Brexit” induced Break-up risks. However, the spotlight has turned back to Greece and Portugal. Recently, the International Monetary Fund has issued rather gloomy statements for both economies. The IMF believes that the cancellation of sovereign debt is almost inevitable for Greece. Moreover, the IMF sees more and more the necessity for a second bailout for Portugal. However, the threat that investors treat Portugal again as an exit candidate is clearly visible in the sentix Break-up index for Portugal (refer to chart 2, red line). The indicator has consistently increased from 0.5 to 3.1 points since August 2015. Unfortunately, the situation could deteriorate in October. Should the Canadian rating agency DBRS withdraw its investment-grade rating of Portuguese sovereign bonds, the ECB is according to the current asset buying regime not eligible to purchase any more.

sentix Euro Break-up Index Greece and Portugal

According to the sentix indicators, an end of the euro crisis is not in sight.