|

26 March 2018

Posted in

sentix Euro Break-up Index News

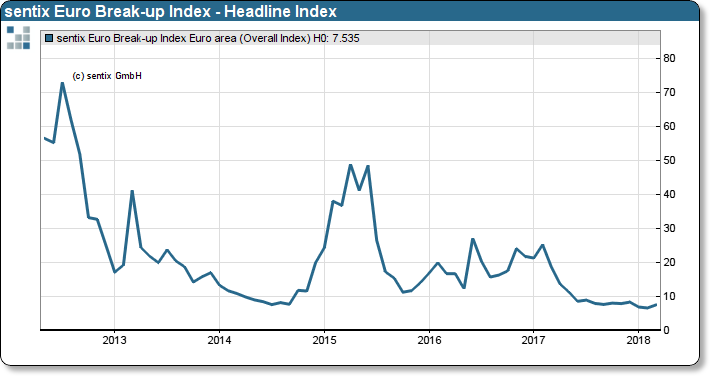

The possible formation of a government in Rome between the two anti-European protest parties does not lead to new fears flaring up in the Euro Break-up Index for Italy and a new Euro crisis being indicated. Rather, the subindex for Italy is stable at 4.7 percentage points. The overall index for the euro zone also rose by only 0.9 percentage points after its all-time low of the previous month.

When it comes to the stability of the euro zone, everyone is eagerly looking to Italy at the moment. About a month after the parliamentary election, investors are relatively relaxed about the continued existence of the Euro. This is astonishing, because the election result would have given every reason to believe that Italy is more likely to withdraw. Nor does the current news that a member of the 5-star movement will become parliamentary president and, at the same time, a representative of the Forza Italia senate president, seem to give rise to any fears. Understanding between populist parties increases the likelihood that they could form a common government. The subindex for the southern country of the euro zone even fell by 0.2 points to 4.7 points.

sentix Euro Break-up Index: Sub-index Italy

A look at the history of the EBI country index Italy shows that a persistent share of investors is still holding, which con-tinues to express concerns. The index has fluctuated between 4.1 and 5.5 points in the last 10 months and had never moved back to the lows of 2016. And this despite the fact that the overall EBI index kept reaching new lows. Ultimately, the level increase signals a subliminal but persistent concern for Italy and thus for the euro zone.

The increase in the EBI headline index from 6.6 to 7.5 percentage points is small, but should continue to be observed. The indicator, which measures the probability of a break-up of the euro zone, had hit a new all-time low in the previ-ous month since the survey began in 2012. A new euro crisis would be possible if a new trend towards expansion emerged in the coming months. Italy could provide the impetus for this.

sentix Euro Break-up Index: Headline Index