|

01 October 2018

Posted in

sentix Euro Break-up Index News

The Italian government's decision to further increase debt has caused enormous volatility in the markets. What is special about this is that investors do not expect this to have any impact on the stability of the Euro-Zone. The Euro Break-up Index even falls in September - including the sub-index for Italy!

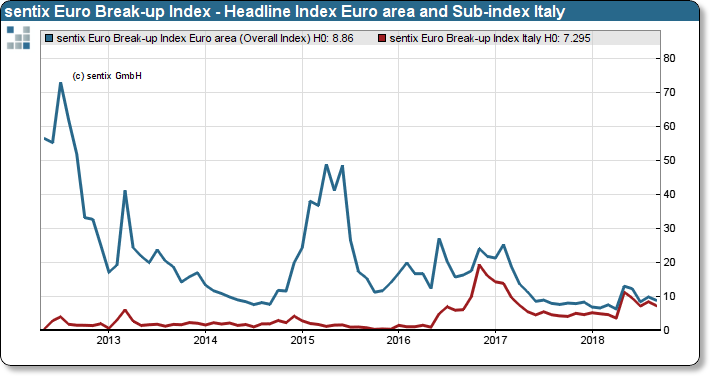

The sentix Euro Break-up Index fell by one point from 9.9 to 8.9 in September! The survey took place after the announcement of the resolutions in Rome and thus reflects the immediate reaction of investors. They are almost unimpressed by the enormous media outrage about Italy's planned new debt in 2019. Italian bonds and shares, especially bank stocks, had reacted very sensitively to the resolutions in Rome in the last few days. This makes a decline in the EBI all the more astonishing. In the same breath, Italy's probability of exiting is downgraded by 1.1 points to 7.3. Italy is still the country with the highest probability of leaving the Euro zone. But the Euro Break-up Index signals that both the potential downgrading of Italian government bonds by rating agencies and Italy's outgoing political signal to the rest of Europe are not seriously threatening Euroland's unity.

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy