|

25 July 2022

Posted in

sentix Euro Break-up Index News

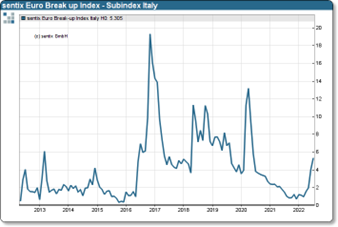

For a long time, the sentix Euro Break-up Index was quiet. This is now changing: With the current government crisis in Rome, the third-largest economy in the EU has come into investors' sights as a potential exit candidate. The sub-index for Italy is rising more sharply.

The resignation of Mario Draghi and the sharp spread widening of Italian govern-ment bonds at German bunds are increasingly pre-occupying investors. The sentix Euro Break-up Index for Italy signals unease. Although the increase is still relatively moderate in a historical context with a value of 5.3 points, the latest dynamics could indicate the beginning of a new trend.

sentix Euro Break-up Index - Subindex Italy

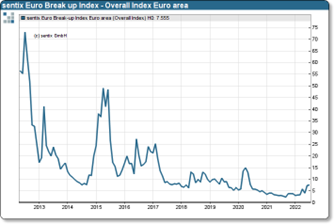

Is a new euro crisis looming? At +7.6 points, the overall index for the eurozone does not yet indicate any worry-ing development. We are a long way from the index highs of 2012 and 2015. Nevertheless, the rounding in the chart must be taken seriously. It would be prob-lematic if a series of EBI deteriorations were to occur in the coming months.

sentix Euro Break-up Index - Overall Euro area