|

29 October 2018

Posted in

sentix Euro Break-up Index News

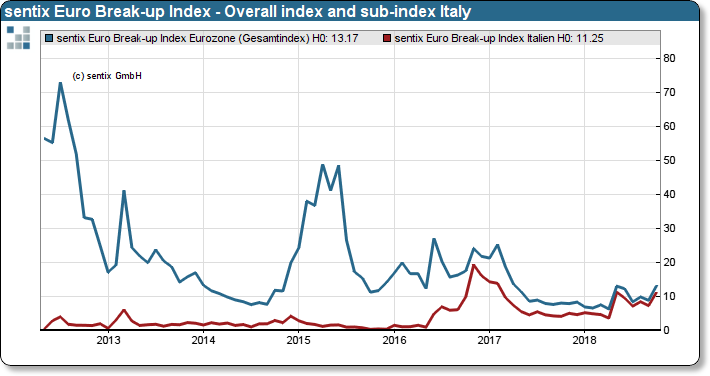

The dispute over Italy's draft budget has now rekindled investors' fears that the euro zone will break up. The sentix Euro Break-up Index rose strongly from 8.9% to 13.2%. This is the highest level since April 2017. The sub-index for Italy jumps to 11.25%.

The dispute over the draft budget of the new Italian government is unsettling investors. Not only the bond spreads reflect this, but also the sentix Euro Break-up Index, which reflects the likelihood of the Euro-Zone collapsing from the investor's perspective. The likelihood of withdrawal rises to its highest level since April 2017, mainly due to the strong rise in the Italian sub-index. While the professional investors are still reacting comparatively cautiously and are appar-ently betting on a "last-minute" concession by the Italian government, the private investors are very clearly affected. More than 15% of the private investors surveyed now consider it conceivable that Italy could withdraw within 12 months. This is well above the figure for May of this year, when the new government was formed in Italy.

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy

On the positive side, the concerns are concentrated in Italy. Investors do not yet fear any negative contagion effects, which is reflected in the low rise of the Greek sub-index and the index for the contagion risk, which even fell slightly from 36% to 33%. The euro and Europe are still not really in danger.