|

25 April 2016

Posted in

sentix Euro Break-up Index News

The sentix Euro Breakup Index (EBI) remains unchanged at 16.7% in April. The force behind the persistent break-up risks remains unfavourable news from the Aegean. Though, investors shift their attention to the European Union level amid an intensifying “Brexit” debate. As investors only see a moderate probability for a “Brexit”, however, the associated risks could threaten the stability of the EU.

Overall, the likelihood of a potential euro break-up scenario remains low at around 16.7% in April. Also, investors perceive lower risks regarding possible contagion effects. The sentix contagion risk index drops by 2 points to 26.16%. Even the failed Dutch referendum about the association agreement between the EU and Ukraine has no visible effects on the sentix EBI values, hence on the stability of the currency block. However, under consideration of the latest developments in the euro-periphery, only Greece remains under scrutiny. In fact, only the Greek EBI value has risen by more than 1 point to 15,7%. In the run-up for the British “in or out” referendum investors react increasingly agitated news about a potential Brexit. The problems of the euro periphery are eclipsed, for the moment.

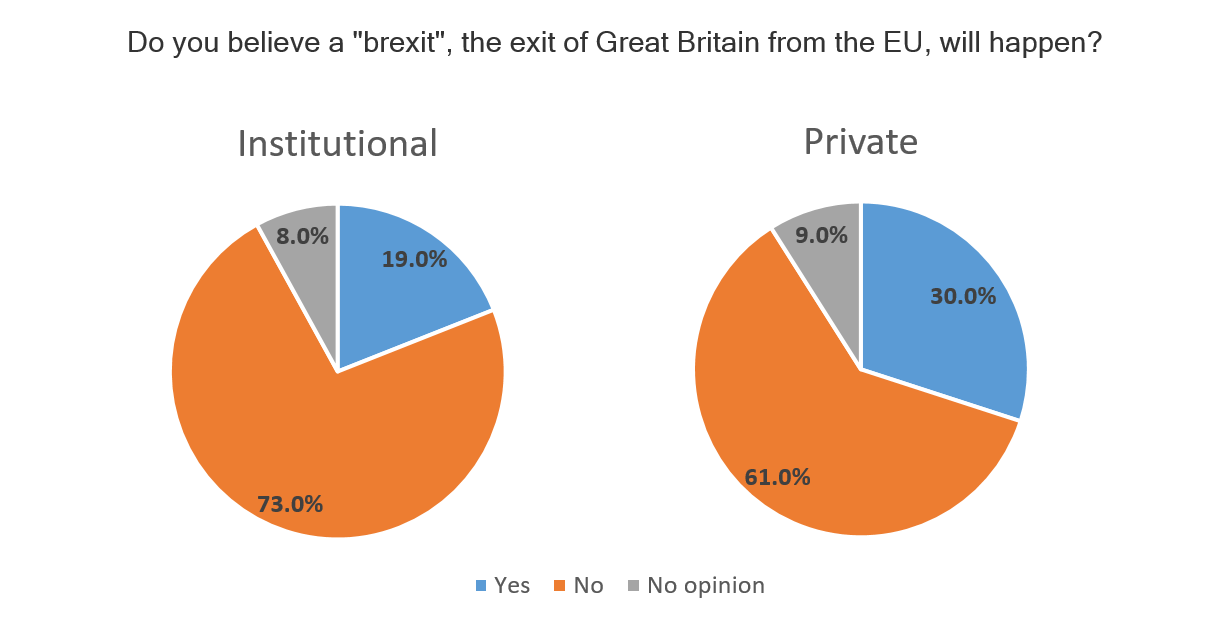

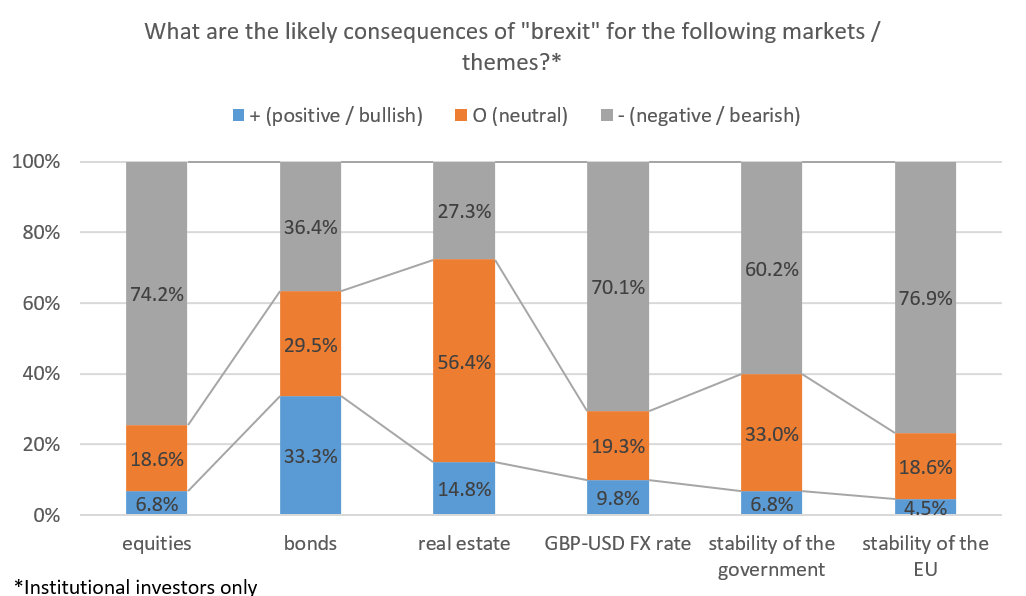

The 1081 investors surveyed by sentix think that the general risk associated with a potential “Brexit” is moderate, at least for now. Only 19% of institutional and around 30% of private investors think that an exit of the United Kingdom from the European Union is imminent. Addressing the question about immediate consequences of a “Brexit” for financial markets, 75.5% of institutional investors reckon that equity markets would be adversely affected. Furthermore, around 70.5% of institutional investors responded that the GBP/USD exchange rate would be hit hard. In contrast, real estate and bonds are seen in a different light. A significant share of investors perceives lower risks for both of these asset classes amid a break-up scenario.

Ultimately, a Brexit would have devastating consequences for the cohesion of Europe according to survey participants. Almost 77% of institutional investors disclose that if does Britain leave the EU, the stability of the Union at its core is at stake.