|

27 May 2019

Posted in

sentix Euro Break-up Index News

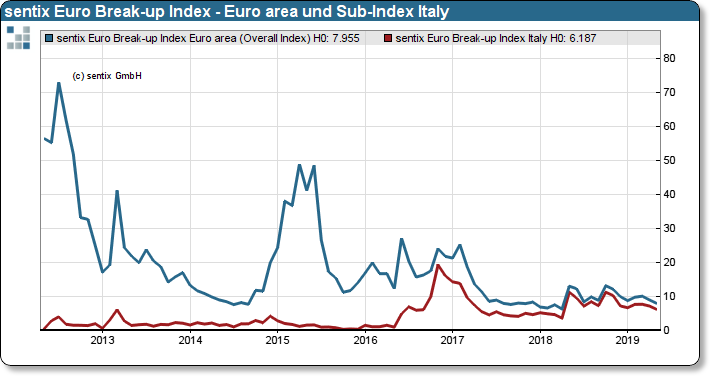

The current survey on the sentix Euro Break-up Index showed relaxed investors before the EU election. The overall index for the euro zone fells further to 7.96%. This is the lowest value since April 2018. The sub-index for Italy is also following this trend and is also falling by 1 percentage point.

Even though the elections to the EU Parliament were often regarded as a choice of fate, this event did not really move investors in the run-up to the elections. Since the beginning of the year, the sentix Euro Break-up Index has shown no major swings and immediately before last weekend's election even a further downward trend. The overall index is below 8%, its lowest level since April 2018, and the sub-index for Italy, the country that investors currently believe is most likely to leave the euro zone, is down to just 6.19%.

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy

Even Theresa May's announcement to resign as the prime minister of the UK on 7 June 2019 did not make a measurable impression on investors when it came to euro stability. After all, around half of the investors surveyed did not vote until after the decision to withdraw. This suggests that investors are assuming that even a hard Brexit and budgetary policy in Italy currently favours measures to strengthen cohesion in the euro zone rather than split trends.