|

01 December 2014

Posted in

sentix Euro Break-up Index News

The sentix Euro Break-up Index (EBI) barely changes in November and now stands at 11.6%. Obviously, Mario Draghi's latest announcements have not really impressed investors as far as the integrity of the common currency is concerned. It is mainly Greece about which investors again worry. But France does not look good either.

The sentix Euro Break-up Index (EBI) had risen from July to October. In the current month, the indicator recedes slightly from 11.8% to 11.6%. Consequently, the latest upward trend is stopped. But a significant decrease does not materialise. This surprises as just recently ECB president Draghi had strongly hinted at soon-to-be-implemented government bond purchases by its institution – a step which should take pressure off the euro's member states. At a conference in Frankfurt Draghi, for instance, said: "[...] we will do what we must to raise inflation". But this commitment does not seem to have had much influence on investors' views about a euro break-up within the next twelve months.

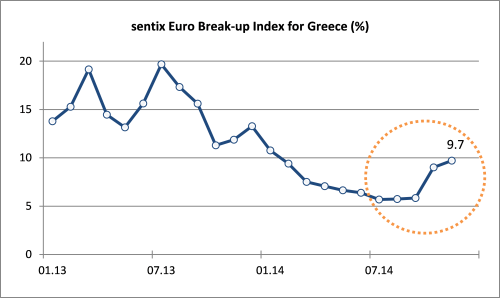

Investors worry increasingly about Greece. Although recession hast just officially ended in the Mediterranean country and the expression "grecovery" was coined, a growing number of investors expects a "grexit" in the coming year: the national sentix EBI for Greece rises the fourth month in a row, currently from 9.0% to 9.7%. This is its highest reading since January (see graph). The unclear financial future of the country and the threat of early new elections in February here have forged investors' perceptions.

And there is something going on in the background, too. While the national EBI for Italy falls again (from 2.9% to 2.3%), the French EBI does not send signs of relaxation. It stays at an all-time high of 2.1% in November. Interestingly, this does not fit with the performance of French government bonds: the yield for French 10-year bonds, for instance, just fell below 1.0% over the last few days. The EBI thus points to a possible erroneous trend and shows how fragile the situation still is.