|

27 July 2015

Posted in

sentix Euro Break-up Index News

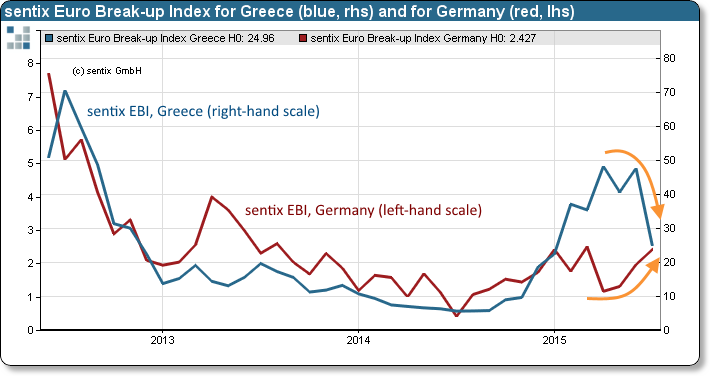

In July, the sentix Euro Break-up Index (EBI) falls from 48.4% to 26.5%, its lowest reading in six months. The reason for this is the rescue of Greece which lets the Hellenic index drop sharply. But against the general trend the EBI increase for Germany and Finland whose government bonds profit from the unresolved euro problems.

Against the backdrop of prime minister Tsipras U-turn and the agreement on negotiations about a third aid package for Greece the sentix Euro Break-up Index drops by almost 22 percentage points to 26.5%, its lowest reading in six months. This is its strongest decrease since the indicator’s launch in June 2012. Only once, in October 2012, after the European Central Bank had detailed its plans to purchase government bonds the indicator had receded more heftily.

Benefitting from the current developments surrounding Greece is, of course, mainly the country itself: the Greek EBI declines from 47.7% to 25.0%, also the lowest value observed since January. Furthermore, the national index for Cyprus decreases markedly from 7.9% to 3.1%, an all-time low! And finally, the EBI for Italy, Spain and Portugal all fall be-low 1.0% and thus below the “detection threshold”.

Meanwhile, the national EBI for Finland (from 1.4% to 1.8%) and Germany rise against the trend (see graph). For Germany the index now stands at 2.4% (after 2.0%) and thus even rather close to the one for Cyprus. Consequently, against the backdrop of the latest, once again unsatisfying rescue of Greece investors think that it becomes ever more probable that the euro-zone core countries will leave the currency bloc in the near future. The better prices of German and Finnish government bonds reflect this thinking already. Is this the beginning of a new rally of these safe havens?