|

27 November 2017

Posted in

sentix Euro Break-up Index News

The last few weeks, which in Germany have been marked by a tough and ultimately unsuccessful struggle for a new government in the form of a Jamaican alliance, have made no difference to the Euro zone from the investors' point of view. The sentix Euro Break-up Index fell slightly to 7.9% in November and is still trading near its all-time low. This means that investors do not worry about Germany's stability and in fact assume that the "grand coalition" will continue, either explicitly or implicitly through a minority government.

It remains to be seen, however, whether this calmness will also bear fruit in the event of more difficult developments in the euro zone. At the moment, it is probably above all the excellent state of the economy that makes the euro zone so resistant to bad news.

sentix Euro Break-up Index: Headline Index Euro area

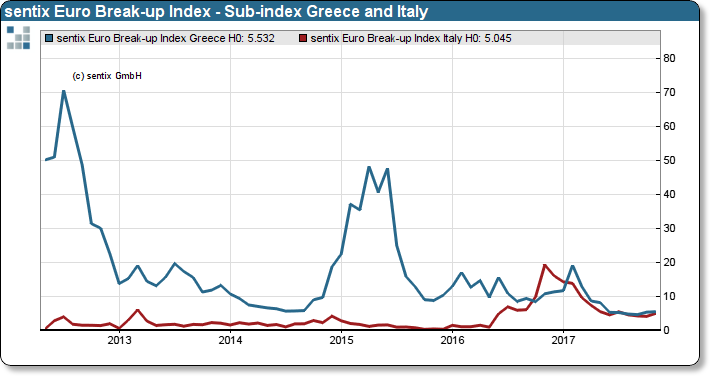

However, doubts about the continued existence of the euro zone do not want to give way. The two problem children are still called Greece and Italy. Investors are not impressed by the Greeks' manoeuvring to restructure their out-standing bonds and thus increase market liquidity and acceptance. Contrary to the general trend, the assessment of Italy has even slightly deteriorated from 4.2% to 5.0%. Investors are anxiously awaiting the upcoming Italian parliamentary elections.

sentix Euro Break-up Index: Sub-index Greece and Italy