|

26 June 2017

Posted in

sentix Euro Break-up Index News

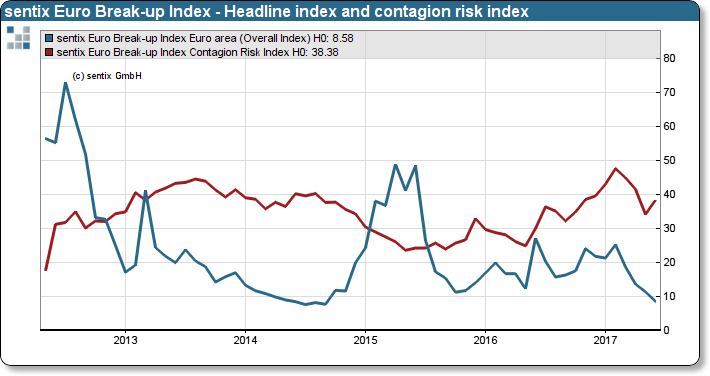

Following the French parliament elections, the fears of a break-up of the eurozone continue to decline. The overall Euroland index fell back to 8.6% (before:11.4%), the lowest level since September 2014. In particular, the Greek sub-index continued its dynamic recreation. This trend could be also noticed for the Italian sub-index. The general trend of reassurance could not be transferred to the index, which measures the contagion risk. It rose from around 34% to 38%.

The enthusiasm caused by Macrons anew election victory provided momentum for the eurozone. The investors see the results as a positive signal for the eurozone and evaluate the election results as a clear commitment to Europa. This signal affects investors' perception of a break-up of the eurozone. The Euroland overall index of the sentix Euro break-up index decreased for the third time in a row to 8.6 points (lowest level since September 2014). If uncertainty still exists at the moment, there may be uncertainty caused by a potential contagion risk. The index which measures the contagion risk increased by around 4%. It reflects the fact that despite the lesser probability of exit in the individu-al countries, too many countries are still identified as problem candidates and a flare-up of the euro crisis by different countries is possible at any time.

sentix Euro Break-up Index: Headline Index Euro area and contagion risk index (left scale)

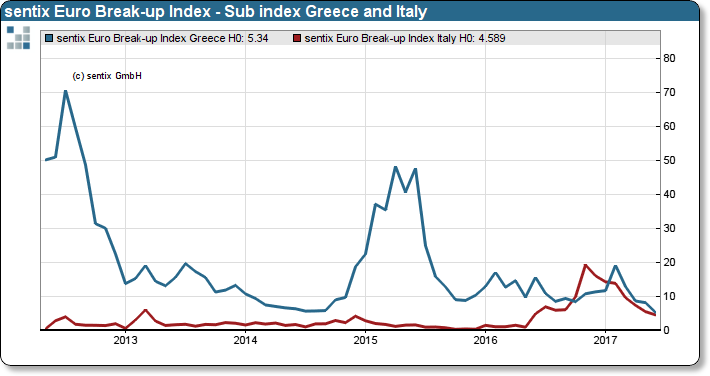

Considered as a whole, the positive results outweigh the negative results: the sub-index for Greece benefits from the recent credit commitments of the EU countries and drops from 8.2% to 5.3%. This level is the lowest level that has ever been measured for Greece since the start of the recording in 2012. For Italy, we are measuring a decrease in the exit risk (from 5.5% to 4.6%) as well. The outcome of the local elections in Italy and the loss of the votes of the 5-star move-ment combined with the suspended new elections have the effect that the fears of a Itaxit declined.

sentix Euro Break-up Index – Sub-indices for Greece and Italy