|

01 May 2017

Posted in

sentix Euro Break-up Index News

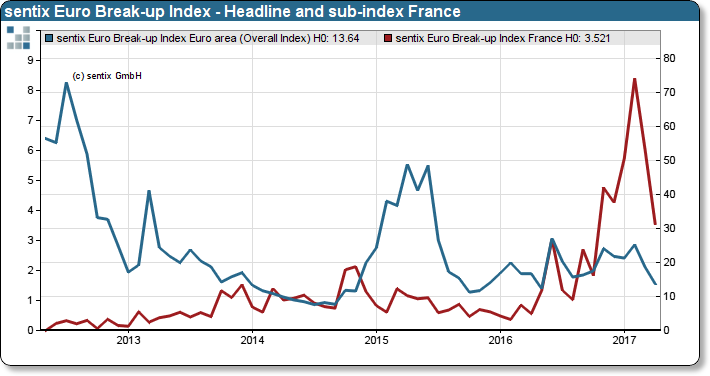

The first election round to the French presidential election has appeased investors' minds. Only 13.6% of investors are now expecting the euro to break-up, after 18.7% in the previous month. For France, the probability of an Euro ex-it (“Frexit”) decreases to 3.5% after an high of 8,4% end of February. However, Greece and Italy remain the most likely potential candidates for exit.

In a sentix special survey, it was already apparent at the beginning of last week that investors consider the French presidential election to be decisive. The favorite from the first round is also clearly expected to be the winner of the competition on May, 7th. According to the political agenda of Emanuel Macron, only 3.5% of investors expect the Euro-zone to disintegrate by an exit of France. At the end of February, the sub-index for France was at 8.4%, at time an election victory of Marine Le Pen seemed still a probable variant. Whether this speculation of the investors will be suc-cessful will be evident in a few days. However, the choice is hardly likely to trigger an additional boost from an expec-tation change. At least not in regard of the Euro crisis.

sentix Euro Break-up Index: Headline Index Eurozone and sub-index France (left scale)

Eurozone investors remain skeptic about Greece (8.7% exit probability) and Italy (7.4%). But both indices have also weakened significantly. This all had a favorable effect on the contagion risk index, which fell from 44.9% to 41.5%.