|

30 April 2018

Posted in

sentix Euro Break-up Index News

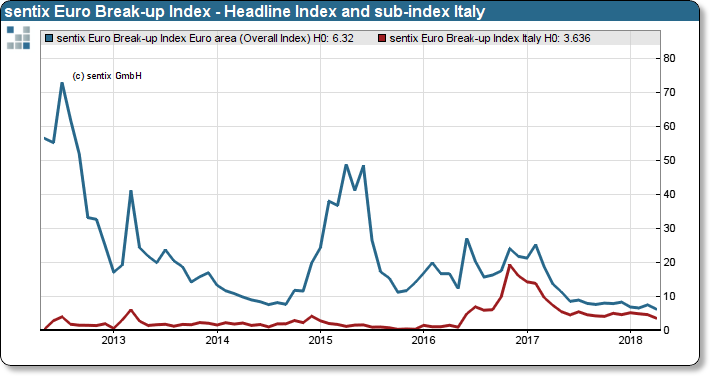

Investors' worries about a collapse of the euro zone will be reduced again in April. The sentix EBI Index again reached an all-time low of 6.3 points. Although the political situation in Italy remains unclear and the economic mo-mentum in Europe has recently dampened, this has no effect on the assessment of the stability of the euro zone.

In April 2018, investors' fears of a break-up of the euro zone will be reduced again. The overall index of the sentix EBI Index reached a new all-time low of 6.3 points. The recent slowdown in economic growth has not led to new concerns among the investors surveyed by sentix about the stability of the euro zone. This is further evidence of the euro-zone's new robustness.

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy

This is also clear with regard to the individual countries under consideration. Although Italy has still not been able to form a new government after the parliamentary elections, this hanging game is not detrimental to the EBI survey. The Italian sub-index fell by 1 to 3.6 points. The Greek sub-index also fell to 3.6 points. Here, investors are rewarding the surprisingly positive budget figures.