|

27 February 2017

Posted in

sentix Euro Break-up Index News

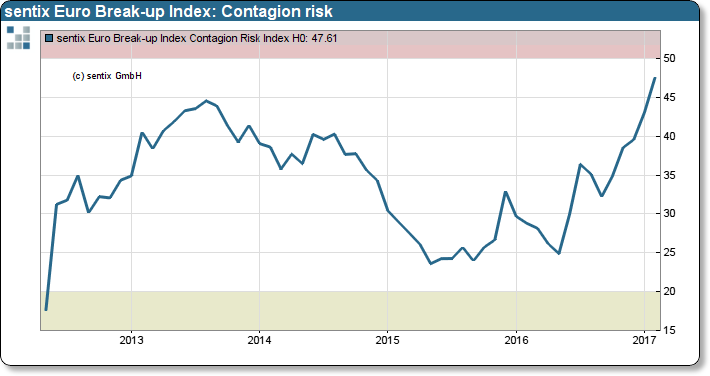

After two years absence, the euro-crisis is back in the spotlight. However, this time is different. The protagonists have multiplied as France and Italy now join Greece as likely exit candidates. The sentix indicator that measures the risk of contagion jumps for the first time since 2012/13 above 45% which puts politics under pressure to curtail the crisis from spreading further.

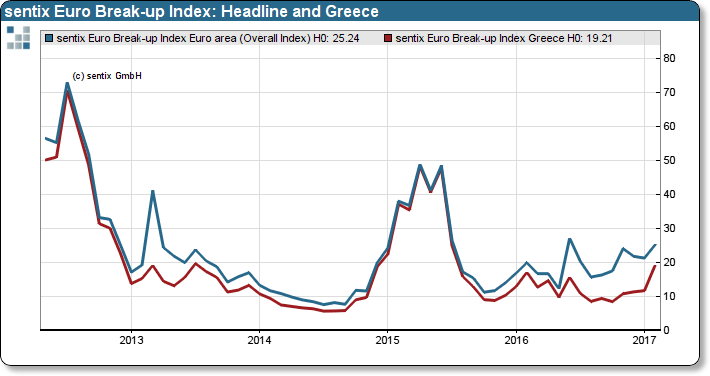

The euro crisis has never completely disappeared over the last years, which becomes apparent these days. As more than 25% of sentix survey participants believe that at least one member state will quit the single currency, our indicator has jumped to risk levels last seen around the time of the surprising Brexit in June 2016. Back then, the sentix Euro Break-up Index (EBI) stood at 27.5%.

We can identify three potential reasons for the latest surge of contagion risk. As the annual interest repayment day approaches, Greece is quasi on schedule back in the media. Effectively, politicians must concede that the rescue policies have failed for Greece. However, as elections approach, politicians suddenly shift their agenda: now austerity is “out”.Nevertheless, investors are not stupid. They review the latest policy changes more as election tactics rather than as a consistent approach which will sustain the upcoming elections in France, the Netherlands and Germany.

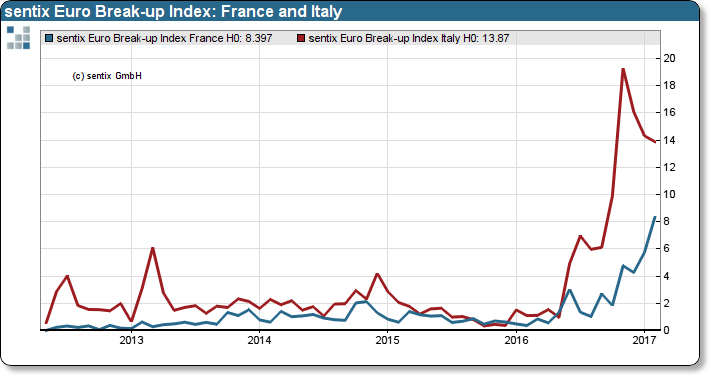

The Eurozone today has more issues than just the condition of Greece.

Despite that, the situation in Italy has calmed somewhat in the recent weeks. However, the sentix Break-up probability remains high at 13.9%. Also, the Break-up probability for France is on the rise. The sub-index for France reads an exit probability of 8.4%, up from 5.7% in January - a new all-time high.

The higher exit probabilities stem from investors uncertainty about forecasters ability to predict election outcomes accurately. Investors fear forecasters might get it wrong again after last year’s surprise victory of Trump and Brexit. Nevertheless, the probability of a surprise election of contending LePen in France’s presidential race is less likely.

Consequently, the euro-crisis has become more contagious. The sentix Index measuring contagion risk passes previous levels last seen during the high of the crisis in 2012/13. Would the euro-crisis be a flue, politicians were not shy to issue pandemic alerts.