|

25 May 2020

Posted in

sentix Euro Break-up Index News

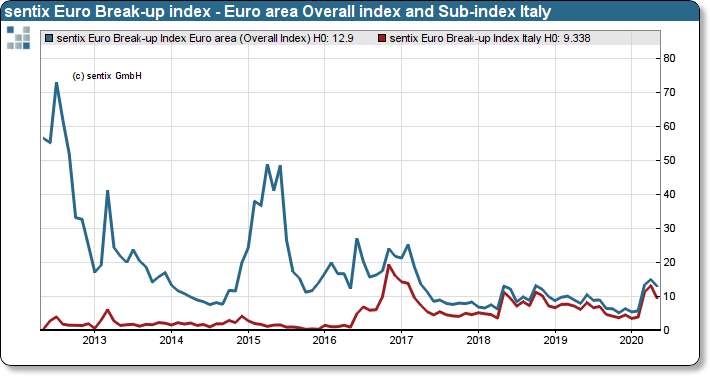

The ruling of the German Federal Constitutional Court, according to which the ECB must make argumentative im-provements in the matter of its bond purchase programme and which some euro critics have already described as the "beginning of the end" of the euro, has not led to a further flare-up of euro worries among investors. The sentix Euro Break-up Index has fallen to 12.9%.

It was a bang and a piece of legal history when the Federal Constitutional Court made the ECB, the European Court of Justice and the German government look equally bad. The ECJ was found to have exceeded its legal competence and the ECB to have arbitrarily exceeded its monetary policy competence. "Detention" was the judge's verdict and called on the ECB to demonstrate comprehensively that the benefits of the bond purchase programme since 2015 outweigh the potential damage to economic policy. But this ruling by Germany's highest court, which clearly holds explosives for the eurozone, bounces off the ECB and all European-inclined institutions. One simply ignores it. What's more, it adds another billion euros in promises for the badly shaken southern countries of the Eurozone.

sentix Euro Break-up Index: Euro area Overall index and sub-index Italy

This policy seems to be catching on for investors. Concerns about a break-up are quickly reduced by around 2.1%. For Italy, the ECI is even falling by almost 4%. A worsening of the euro crisis has thus been cancelled for the time being. Until in a few weeks' time, money will run short again due to a persistently deep economic crisis in the chronically loss-making countries. The spirit of a new euro crisis is out of the bottle and will not return to it in a recession.