|

31 January 2017

Posted in

sentix Euro Break-up Index News

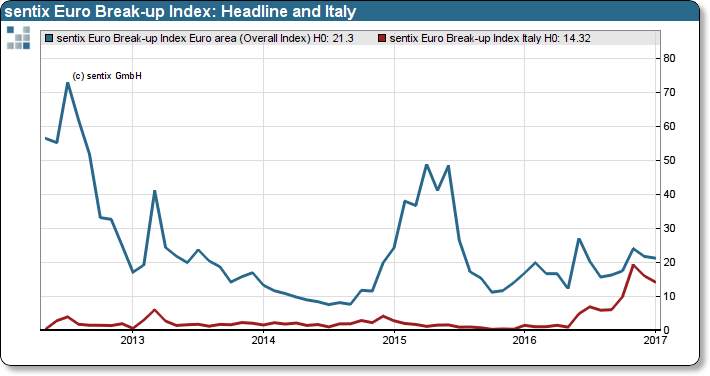

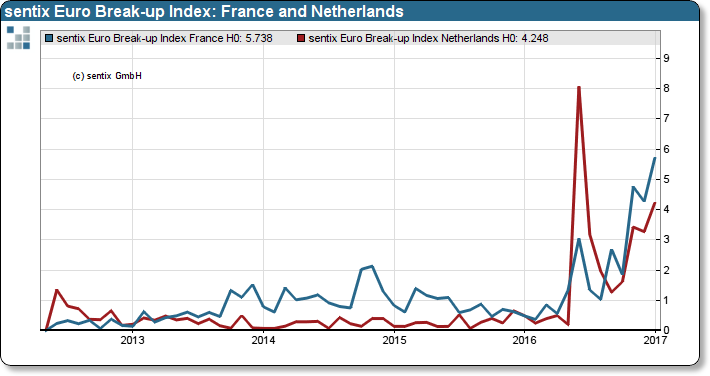

The start of the new year is accompanied by ongoing euro skepticism. This is also helped by the important elections in the coming months. The EBI figures for the Netherlands and France, which are noticeably rising, show just how much investors are looking for "correct" choice of options. Overall, the likelihood that a country will leave the euro remains high at 21.3%.

The stability of the single European currency remains a concern for investors in 2017 as well. The sentix Euro break-up index, which reflects the likelihood of a Eurozone break-up, drops only slightly from 21.8% to 21.3%. While the acute concerns about Italy have declined somewhat (nevertheless, Italy remains the country with the highest exit probabil-ity), the countries with upcoming parliamentary and presidential elections are in the focus of investors.

For the Netherlands, we recorded a rise in the EBI from 3.3% to 4.2%. This is lower than the peak recorded immediately after the British Brexit vote. However, the trend is now clearly pointing upwards again.

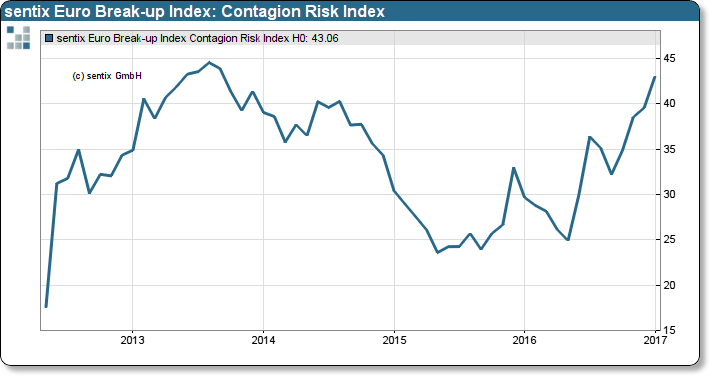

Four countries are now in an unfavorable trend: Greece, Italy, France and the Netherlands. This is a wave of uncertainty in Europe that is pointing to a clear risk of contagion for the euro crisis.

In the sentix contagion risk index, this can be read off easily:

For Europe's top politicians there are enough reasons to be concerned.