|

25 March 2019

Posted in

sentix Euro Break-up Index News

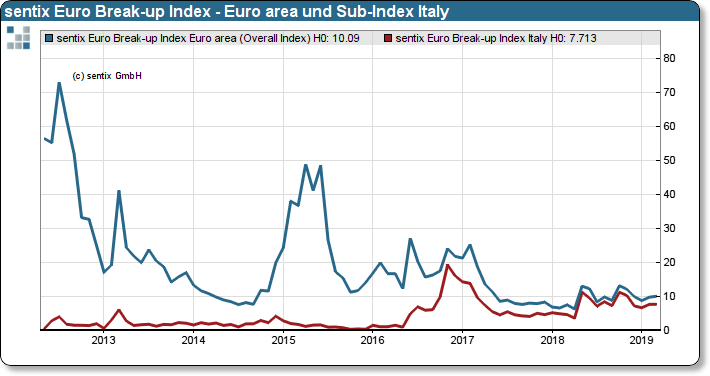

Despite the turbulence surrounding the further development of Brexit and the continuing concerns about the state of the Euro zone economy, investors remain relatively relaxed with regard to euro cohesion. The Euro Break-up Index rose only marginally from 9.8 to 10.1 points.

Mario Draghi continues to have investors well under control when it comes to "confidence in the euro". The central bank's decision to continue supporting the economy with ample liquidity beyond the summer and to nip in the bud any expectations of a tighter monetary policy is apparently being well received by investors. Despite continuing uncertainties about the state of the global and European economies and the drama surrounding Britain's withdrawal from the European Union, this is not reflected in investors' expectations about the stability of the euro.

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy

Although Italy is still seen as the number one problem child, the sub-index for Italy remains almost motionless at 7.7%. A real uncertainty about the stability of the euro zone would look different. Besides Italy, there is hardly a second trouble spot to be seen after investors have "lost sight" of Greece.

Accordingly, the index for the risk of contagion, at 31.45%, is also at its lowest level since mid-2016.