|

30 December 2019

Posted in

sentix Euro Break-up Index News

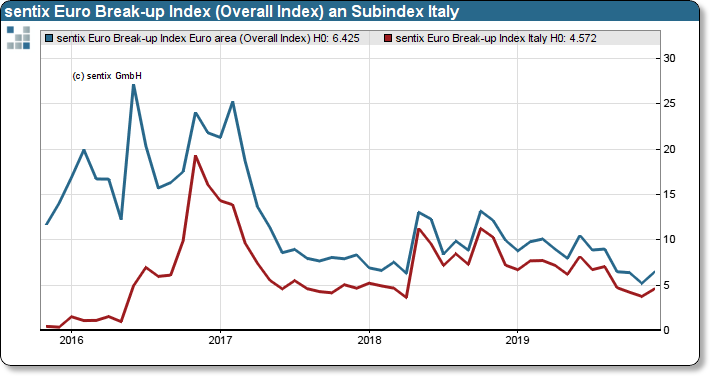

After an all-time low in November, the Euro Break-up Index rose by 1.2 points at the end of the year. Besides Italy and France, the sub-indices of Malta and Estonia are also rising.

The Euro Break-Up Index leaves 2019 with a value of 6.4. After all, the probability of exit has fallen by 3.5 points within 12 months, and investors thus rate the stability of the euro zone better than a year ago. 2019 has thus become a year of relaxation, with only the Italian sub-index reporting any notable swings. However, this country has also benefited from a spooky calm recently. With the election of Ursula von der Leyens as EU Commission President, Italy's budget deficits were declared a minor issue and a change in policy was heralded. Fiscal stimulus is the order of the day and the new ECB chief also supports this course. Investors have prepared themselves for Europe to move even closer togeth-er and a closing of ranks between ECB policy and fiscal policy. Budget deficits are thus tolerated, which ultimately brings international investors to the table.

sentix Euro Break-up Index: Euro area Overall index and sub-index Italy

This will require a risk premium. If more use is made of fiscal leeway, this will automatically mean a higher level of debt. This is likely to put pressure on the yields of countries such as France, Italy, Spain and Greece. The turnaround in the Euro Break-up Index should therefore be more than just a cue. In 2020 a substantial rise in yields on government bonds in the Euro zone could be imminent.