|

28 August 2017

Posted in

sentix Euro Break-up Index News

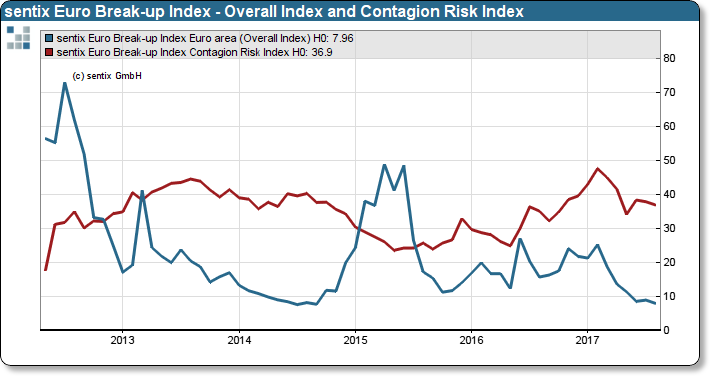

Investors look at the Eurozone with astonishing serenity. Neither the prospect of an early ending of the ECB purchase program nor the decision of the Karlsruhe Constitutional Court (referral to the European Court of Justice) or the political ideas in Italy (introduction of a double currency) have unsettled investors. The sentix Euro Break-up In-dex drops to 8.0% (from 8.9%) and the sub-index for Italy also drops from 5.5% to 4.6%!

In August, the sentix EBI Index shows a surprising development. Although it was not lacking in issues that could cause investors to become unsafe, the investors show themselves astonishingly relaxed. The overall index falls to 8.0%, which is only just above the all-time low, which was measured in July 2014. In view of the fact that the German Federal Constitutional Court has referred the ECB's practice to the loan purchase program for review, it was not necessarily suspected.

sentix Euro Break-up Index: Headline Index Euro area and contagion risk index (left scale)

Equally surprising is the decline in the Italian sub-index to only 4.6%, with which Italy has returned the red Euro-lantern to Greece. At the same time, Italian policy is increasingly dominated by forces that are viewed as Euro-critical. Investors are wiping all these issues aside, as the eurozone economy is in a good state and, in this context, a sustained flare-up of the crisis is not feasible.