|

28 October 2019

Posted in

sentix Euro Break-up Index News

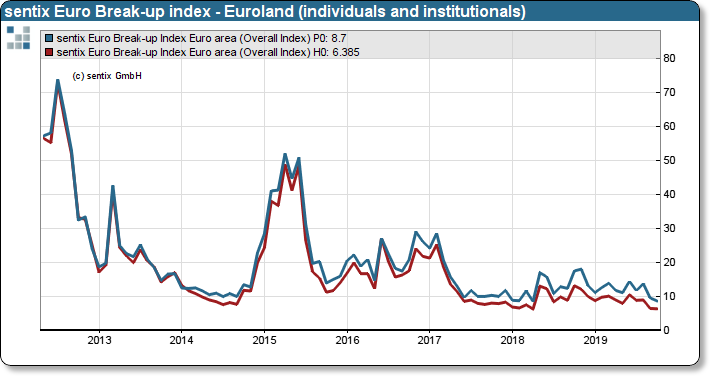

The term of office of ECB President Mario Draghi was dominated by the struggle for the stability of the euro area. While the ECB was still confronted with serious doubts about stability in 2012, the situation has changed significantly to this day. The sentix Euro Break-up Index is close to its all-time low.

This week ECB President Mario Draghi hands over the baton to his successor Christine Lagarde. The Frenchwoman, former head of the International Monetary Fund (IMF), is confronted with many monetary policy challenges and questions. At one point, however, the house seems to be in good shape: investors are currently not questioning the euro. With a value of 6.38%, the sentix Euro Break-up Index is trading just above its all-time low. Mario Draghi kept his word: he did everything he could to keep the euro together - and it was enough. Both investor groups surveyed by sentix share this finding, although the residual scepticism among private investors is even more pronounced than among the professionals, for whom an end to the Euro uncertainty was already marked in 2017.

sentix Euro Break-up Index: Overall Individual Investor Index and Overall Institutional Index

Now follows Madame Lagarde, a new president who will not only develop her own language, but who, as a politician, will also be viewed with a certain suspicion by investors from a monetary point of view. But since she was able to ex-perience the Greek tragedy at close quarters, she can be trusted to act no less decisively when it comes to the euro than her predecessor. Investors are giving her that trust.