|

30 October 2017

Posted in

Special research

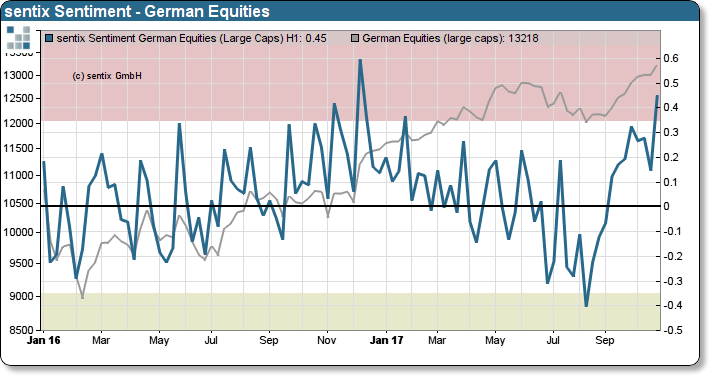

How much the world can change for investors within two months! In the middle of August, we had still measured panic among the investors. Two months later, the mood has changed completely. Now there is almost a euphoric sentiment. In August, the (still unresolved) North Korean conflict was in the center of consideration, now it is the prospect of a further expansive monetary policy and the robust economy that the investor is concerned with.

Panic-level sentiment is usually a promising opportunity for investors to take advantage of the "sentiment value" of the market. So also, this time. The bad mood went down with a low and since then the German stock index has laid a brilliant rally. The average 6% yield, which follows a negative sentiment signal, was even significantly exceeded.

sentix Sentiment – German Equities

The outlook for earnings looks completely different in the case of an optimistic sentiment picture. A jubilation mood does not necessarily mean a price collapse. Investors should not expect positive net yields in the next four weeks. And this, although now the seasonally good phase begins. Whether it comes to an end-of-year rally, decides on the further course of the strategic bias. This is still relatively robust, but is currently weakening. This should not continue if up to Christmas still price gains should follow.