|

14 September 2015

Posted in

Special research

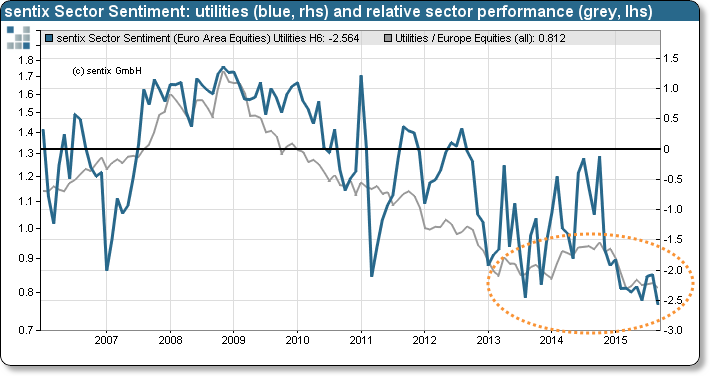

The latest sentix data set reveals further deterioration in investors’ sentiment for the European utilities sector. It has reached a record low and predominantly reflects the condition of distinct German utility companies – an investment opportunity!

The sentix Sector Sentiment for Europe’s utilities shares fades and marks a historical all-time low (see figure below). Never before has such a depressed industry mood been recorded. A possible explanation for investors’ perception are ill-shaped German utility companies, still heavy weights in the corresponding STOXX 600 sector index. Accordingly, with regards to relative performance, European utilities excluding RWE and e.on perform not that bad. In the eyes of investors, only two stocks overshadow the performance of a whole sector – an intriguing issue.

In addition, the extremely negative sentiment shows that a vast majority of market participants have already turned their backs on utility stocks. This is usually a sign of a coming recovery in relative performance. For the European utilities sector this phenomenon was observed in 2013/ 2014, for instance (see again figure). Thus, the industry looks like an attractive opportunity for contrarian investors.