|

15 August 2016

Posted in

Special research

Since February, investor confidence in Chinese stocks has increased continuously. This is a positive signal for the equity market. The current impulse in sentix sentiment, measured in this week’s sentix Global Investor Survey, is now expected to translate the beliefs into concrete portfolio actions.

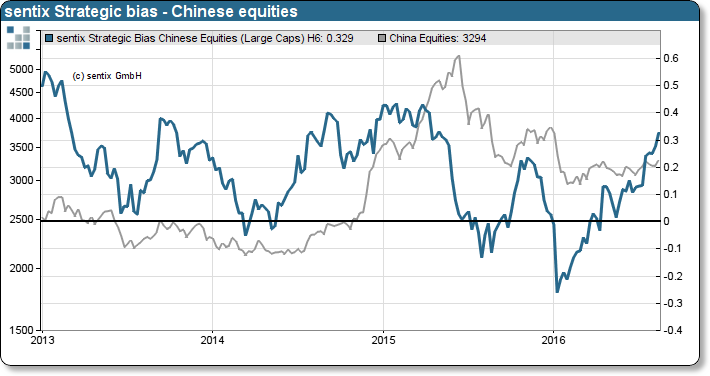

The sentix Strategic Bias measures the expectations of investors in a market over the next six months. This medium-term consideration of the Index reflects the basic trust or perception of value of investors. Therefore, it is usually a leading indicator on portfolio actions. The chart below shows the index for China compared to the Shanghai Composite stock index. The negative turnaround of the index in 2015 for example provided impressive evidence of this forecasting abilities. Currently, the bias increases continuously and vigorously. Investors should therefore increasingly move to the buy side. As in the recent sentix investor survey also a sentiment impulse could be measured, many investors should feel the pressure to act according their beliefs.

Thus, the prospects are good that the prices on the Chinese stock market continued in the next few weeks to show an upward trend.