|

19 February 2020

Posted in

Special research

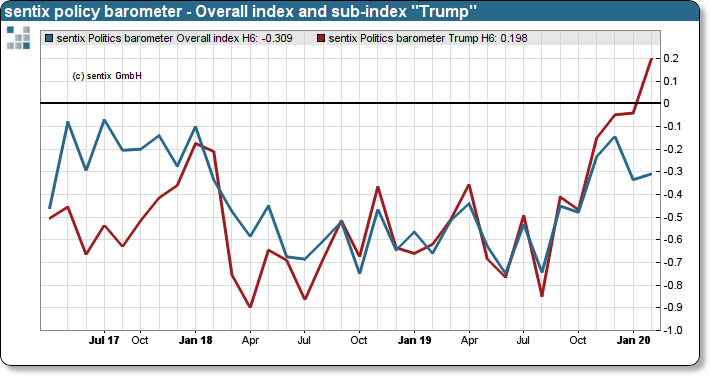

The latest sentix policy barometer reveals that investors no longer see the person of the US president as a burden on capital market development. The partial agreement in the trade dispute has also contributed to this.

Since the beginning of 2017, sentix has been regularly surveying investors' assessments of political issues. Since his election at the end of 2016, the US president has been the subject of fierce political controversy, which is why the atti-tude of investors towards Trump is measured in a partial index. The focus is not on the political assessment in the sense of approval or rejection of his policies or person, but rather on whether he exerts a positive or negative influ-ence on the capital market through his policies or person.

sentix policy barometer - Overall Index and sub-index "Trump”

The values have been climbing significantly since summer and for the first time we are now measuring a predominant-ly positive impact. The partial agreement in the trade dispute with China may have contributed to this. However, this development could also reflect the fact that re-election - which has become more likely as a result of the end of the impeachment proceedings against Trump - is viewed rather positively by investors.

Across all sub-indices, however, politics remains a burdening factor, largely due to geopolitics. All other sub-indices are only slightly negative.