|

15 May 2017

Posted in

Special research

According to the French parliamentary elections, which gave the desired result from the investors' point of view, investors now see a neutral impact of political questions on the financial markets. Brexit, geopolitics and the US president, however, are stress factors. The latter must fight with a noticeable loss of his nimbus.

The new sentix policy barometer rises after the elections in France from -0.46 to -0.08 points. Investors therefore do not expect any major disturbance maneuvers on the part of the politicians in view of the next three months. It is interesting to note that investors now see upcoming elections as an slightly supporting factor, which is surprising in view of the open power issue in France in the run-up to the June parliamentary elections.

Brexit (score -0.36), geopolitics (-0.46) and Trump (-0.46) remain the main risk factors for investors. Above all, the US president is increasingly misguided by investors. His already weak personal approval values (from January to the pre-sent decrease of -1.2 to -1.33 points) are now accompanied by a markedly deteriorated technical approval rate (-1.1 af-ter -0.71 in January).

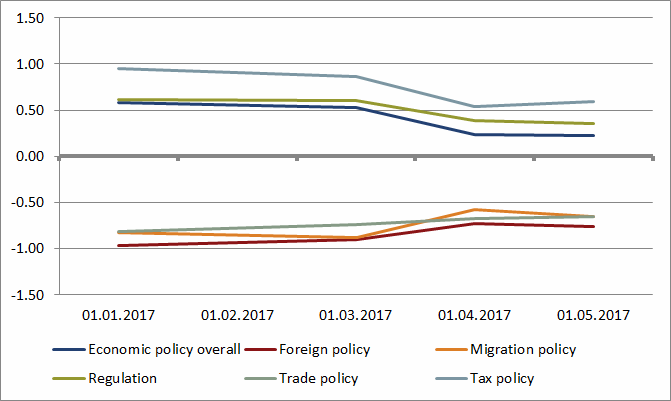

It is remarkable how the evaluation of individual policy areas has changed. Trump's strong strengths, economic excel-lence and the prospect of tax cuts have suffered significantly, while the worst fears about trade and geopolitics have not been confirmed so far.

Recent developments around Trump have shortened the “expected duration” of the US President's term from 4.14 years to 3.74 years. And this even though he had already taken 4 months of his term in office and that the average value should therefore rise.

An impeachment in its second year in office becomes an increasingly probable option for many investors. Whether it is also realistic, will have to prove itself. The loss of the US president's nimbus is already clearly felt, and should help to keep the "theme" to investors.