|

22 April 2020

Posted in

Special research

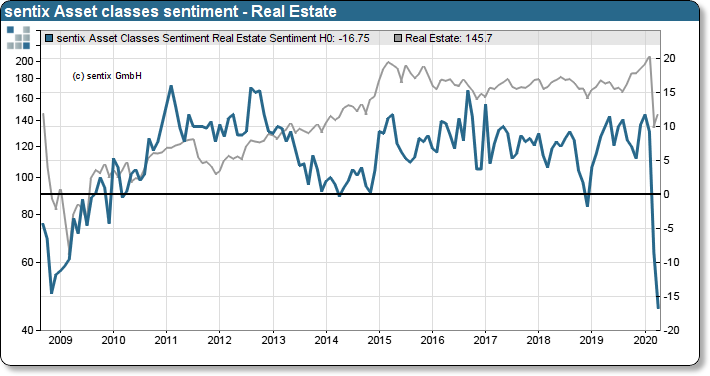

On the surface, the corona crisis affects the leisure and tourism industry in particular. Investors in real estate still think they are on the relatively safe side. But the sentix Styles indices show that the real estate sector is also being viewed increasingly critically. Are there still major negative effects here?

The verdict of the investors is clear and strong: The assessment of real estate is collapsing once again, and this month has reached its lowest value since measurements began in 2008! Obviously, investors are expecting greater burdens that still lie ahead for the real estate markets. On the surface, real estate only seems to be affected to a medium degree, for example by non-payment or deferred payment of rent. But the problems are more diverse. On the one hand, real estate trading has come to a standstill, as no inspections can be carried out. But this is only temporary. After a resumption of the brokerage business, the revaluation of real estate is likely to be the main focus. Especially retail or tourism real estate should remain a permanent burden.

sentix asset classes sentiment on Real Estate and Stoxx 600 Real Estate Index

But other real estate segments could also come under pressure. Particularly if rising unemployment were to replace the currently preferred short-time work after all, or if service providers who primarily use offices were to be negative-ly affected by a revision of investment plans later in the year. For one thing is clear: many things are currently at a standstill and hardly any decisions of major significance are currently being made. In autumn, there could still be the threat of a late awakening, when it is clear that the economy is not recovering quickly, but rather slowly.