|

20 June 2016

Posted in

Special research

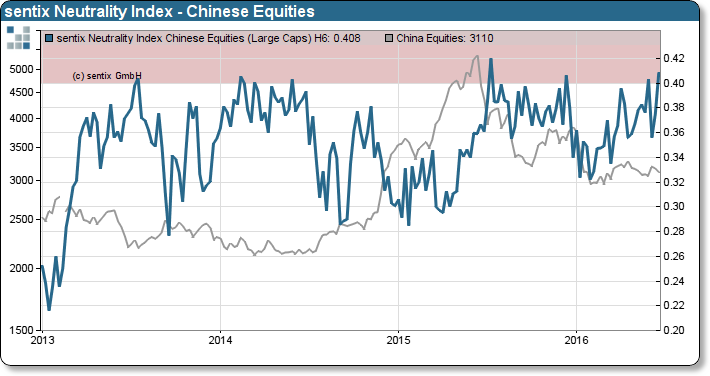

Investors’ uncertainty about the Chinese equity market rises to the highest level since November 2015. The sentix time series reveals that comparable neutrality levels were usually a leading indicator for a new market trend.

The latest sentix Global Investor Survey hints towards an upcoming directional impulse in the Chinese equity market. The Neutrality Index for the CSI 300, which captures the percentage of investors holding a neutral point of view to the future equities market development in China, climbs to the highest level since more than 26 weeks (refer to the chart, blue line). About 41% of survey participants express a neutral opinion when it comes to Chinese equities. Hence, a significant sign of either investors’ nervousness or a lack of orientation about the direction the Chinese stock market is heading. Over the recent years, however, comparable sentix Neutrality levels preceded directional trends as investors had altered their equity positions (refer to the chart).

At the beginning of the year, investors’ behaviour was dominated by the fear that the Chinese economy could suffer from a “hard landing”. With the intense debate about the risks associated with a “Brexit”, though, investors’ attention has shifted towards Europe. Improving economic indicators could not convince investors taking neither a bullish nor a bearish position in the Chinese equity market. Should investors change their perception about China after the “Brexit” referendum, however, the breeding ground for a directional market move is set.