|

23 November 2015

Posted in

Special research

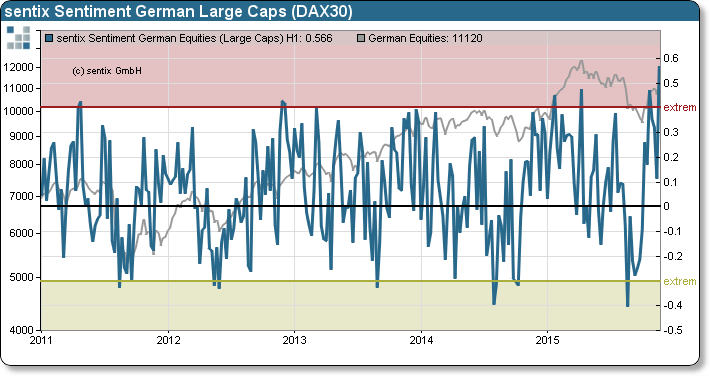

The latest investors’ sentiment towards German large cap stocks nearly reaches an all-time high. Since inception in 2001, the sentix Global Investor Survey has only shown comparable levels twice. The current sentiment level bur-dens not only stock markets in the near future, but also signals medium-term effects.

The latest sentix Sentiment Index for German large cap stocks reaches nearly the highest level ever recorded since inception in 2001. The sentix Sentiment captures market expectations of surveyed investors for a one month period; expressing an emotions spectrum from fear to greed. Lately, almost 65% of survey participants indicate that they are “bullish” (optimistic) towards German large caps, whereas only 8% are “bearish”. The presented index value of 0.57 (see graphic) represents the difference between bulls and bears. The message of the ECB to engage more active in financial markets and prop up asset prices has not failed to reach its target audience. Technically, an extreme positive sentiment reading is an indicator for an overstretched market. Therefore, a contrarian signal. An overhang of bulls must equilibrate to the level of bears in the market via a stock price adjustment, eventually.

Linked to the stock price adjustment process in the short-run is a more far-reaching message: As the sentiment reached comparable positive levels only twice in the indicator’s history, the subsequent effect was that investors had to bear significant losses in the year after. That this time is going to be the same is not guaranteed, yet. However, in financial markets it can be quite painful to strongly believe “this time is different”.