|

16 August 2018

Posted in

Special research

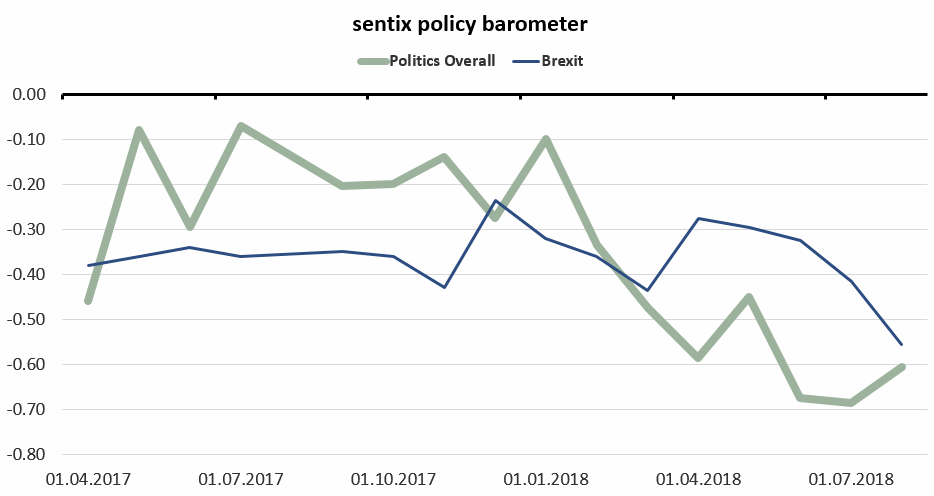

Since the beginning of the year, investors have perceived political issues as clearly weighing on the stock markets. So far, geopolitical issues and US President Trump have been the main influences. Despite the Turkish crisis, the sentix policy barometer has not deteriorated in this respect. But another topic is moving ever stronger - and negative! - into focus.

The decision of the British people to leave the EU in the summer of 2016 was a sensation. After that it became quiet. Negotiations on how to implement such an exit are underway and many are still secretly hoping that the Brexit decision could perhaps still be reversed. Thus, the brexit smouldered for many months. In the meantime, however, the actual completion date, March 2019, is approaching and it is becoming apparent that there could be no solution that is satisfac-tory for all parties. Open questions, such as the Northern Ireland issue, and Premier May's domestic weakness are in-creasingly proving to be a problem. The consequence is that the Brexit clearly appears as a negative topic on the radar of investors.

sentix policy barometer: Overall index and sub-index Brexit

A "hard brexit", as a result of a lack of political visions and agreements, is becoming increasingly probable - and its nega-tive effects on the financial markets could soon become clearly visible.