|

13 February 2017

Posted in

Special research

Investors’ confidence in the equity markets takes a beating. The respective sentix indicator for both, the US and European markets continues its decline. Although investors review their stance on equities, stock prices rally. Risks are lurking due to this discrepancy.

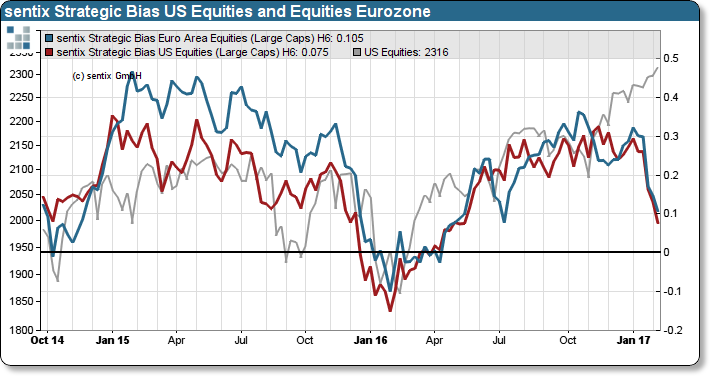

Equity prices, based on the S&P 500 (refer to the chart, grey line), and the sentix Strategic Bias for the US stock market (red line) continue to diverge. The sentix Strategic Bias expresses investors’ medium-term confidence in the financial markets. Moreover, the willingness to sell positions usually correlates with a falling level of confidence. Investors’ faith in the equity markets is currently intertwined with the general sentiment towards President Trump and media coverage. Furthermore, investors have based their decisions to buy the US market primarily in the hope that President Trump will deliver on his campaign pledges to boost the economy. Despite his business on other promised issues, he still hasn’t focused on economic policy. Hence, the larger the divergence between equity prices and the lower the confidence of investors, the higher is the US equity market at risk.

In addition to rising risk levels, the latest data setup reveals another issue. Investors do not discriminate between European (refer to the chart, blue line) and US stock markets (red line). Despite the expected effects on the exchange rates of US economic policies under the administration Trump, investors do not exhibit a concise opinion. Instead, confidence in both, the US and the European stock market suffers. Historically, such an ambiguous view is a short-term phenomenon.