|

15 March 2018

Posted in

Special research

Anyone who thought that after the Italian parliamentary elections there would be calm on the political front is mistaken. Elections and the euro crisis have indeed faded into the background for investors, even though it is far from easy to form a government in Italy. Instead, the fire head on the other side of the Atlantic is making headlines again and is unsettled with protectionist slogans. For Trump himself, however, this seems to be paying off.

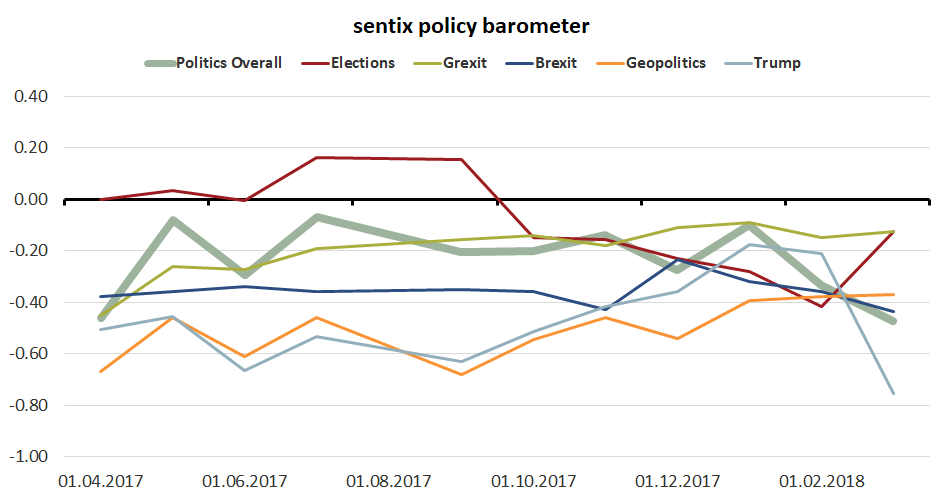

The sentix policy barometer dropped further in March from -0.4 to -0.47 points. And this despite the fact that investors are reporting an easing of tensions in these policy areas following the elections in Italy and the formation of a government in Germany. The cause is once again on the other side of the Atlantic. US President Trump, with his protectionist rhetoric, has not only alarmed EU Commission President Juncker.

The sub-index "Trump" plunges into the depths by a whopping 0.6 points and reaches a new low. A closer look at US policy areas reveals the new focus on possible trade restrictions very clearly. The component index for US trade policy falls sharply from -0.51 to -0.91 points. At the same time, the positive assessment of U. S. tax policy is beginning to fade somewhat, which is also likely to be due to an acclimatization effect on the part of investors.

Overall, US economic policy is judged more negatively by investors surveyed by sentix following the US president's renewed plea.

Increased chances of re-election due to harsh rhetoric

Interestingly, the negative rhetoric doesn't color on Trump as a person! The assessment of professional and personal competence has hardly changed in the last few months, and if so, even marginally. This is probably also a habitual effect.

However, there is one message that should please the US president - and probably also continue to shape his future actions: investors believe that his chances of re-election are likely to increase as a result of this policy of uncompromisingness. Investors now expect the US President to remain in office for an average of 4.36 years, compared with just over 4 years ago. More than 20% of all investors now expect a successful re-election!